Insurance serves as a safety net, offering financial protection and peace of mind in times of uncertainty. However, the cost of insurance premiums can often strain our budgets.

Insurance serves as a safety net, offering financial protection and peace of mind in times of uncertainty. However, the cost of insurance premiums can often strain our budgets.

The good news is that negotiating insurance premiums is not an elusive skill but a practical approach to make insurance more affordable without compromising coverage.

I’m sharing this article because I’m a best-selling wellness author – known for my health-boosting longevity book, Life is Long.

Inside my book I share a range of proactive health tips – because I believe it’s best to do everything you can to prevent health issues – as much as you can in advance of any problems. The same goes with my philosophies on insurance.

So, in this article, I will be exploring expert tips and effective strategies to successfully negotiate insurance premiums.

Understanding Insurance Premiums

Insurance premiums are the lifeblood of any insurance policy. They are the periodic payments you make to the insurance company to keep your coverage active. These payments ensure that you are financially safeguarded in case of unforeseen events. The calculation of insurance premiums is based on several factors, such as your age, location, driving record (for auto insurance), health condition (for health insurance), and the type and extent of coverage you opt for.

Expert Premium Negotiations with Bennet & Porter Insurance

Bennet & Porter Insurance, a well-established and reputable entity in the insurance landscape, brings decades of expertise to the realm of negotiating insurance premiums. With a profound understanding of the intricate nuances within the insurance industry, they have earned a stellar reputation for their unwavering dedication to their clients.

When it comes to negotiating insurance premiums, Bennet & Porter Insurance stands out as a reliable partner. Their experienced team acknowledges that every individual’s insurance needs are unique. Whether it’s auto, home, health, or any other form of insurance, they take a personalized approach to cater to each client’s specific circumstances. This personalized approach ensures that clients not only have the right coverage for their needs but are also positioned for successful negotiations.

Navigating the world of insurance can be overwhelming, and understanding the intricacies of premium negotiations can be a challenge. This is where the expertise pros comes into play. They recognize that insurance premiums can pose challenges to budget-conscious individuals and families. Therefore, they go the extra mile to guide their clients through the negotiation process, leveraging their extensive knowledge to secure premium rates that align with clients’ financial goals.

Proven Strategies for Successful Negotiations

When it comes to negotiating insurance premiums, having a well-defined strategy is crucial. Here are some proven strategies that you can consider:

- Research and Compare: Start by thoroughly researching different insurance providers and their offerings. Obtain quotes from multiple companies and compare their rates. This not only gives you a broader perspective but also provides you with a competitive edge during negotiations.

- Review Your Current Policy: Before entering negotiations, review your existing policy in detail. Identify areas where you might be overinsured or paying for coverage that you no longer require. This information can be invaluable during negotiations.

- Bundle Your Policies: Many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance. Bundling not only simplifies your coverage but can also lead to more favorable premium rates.

- Maintain a Strong Credit Score: Believe it or not, your credit score can influence your insurance premiums. A higher credit score can lead to lower premium rates, as it reflects financial responsibility.

- Adjust Deductibles: Opting for higher deductibles can lead to lower premium costs. However, assess your financial situation to ensure that you can comfortably cover the deductible in case of a claim.

- Emphasize Loyalty: If you’ve been a long-term customer with your insurance provider, highlight your loyalty during negotiations. Many companies appreciate loyal customers and may offer discounts to retain your business.

- Highlight Security Measures: For home and auto insurance, implementing security measures such as alarm systems and anti-theft devices can lead to premium reductions. Mention these measures during negotiations.

- Complete Defensive Driving Courses: If you’re negotiating auto insurance, consider enrolling in defensive driving courses. Not only do these courses enhance your driving skills, but they can also lead to lower premiums.

The Negotiation Process

Initiating contact with your insurance provider is the first step in the negotiation process. Whether you choose to make a phone call or send an email, approach the conversation with politeness and professionalism.

Clearly communicate your desire to discuss your premium and seek potential ways to reduce costs. Listen attentively to the representative’s responses and consider any alternative options or discounts they propose.

Conclusion

Negotiating insurance premiums is a practical and achievable endeavor. By investing time in research, evaluating your current policy, and implementing effective negotiation strategies, you can successfully lower your insurance costs while maintaining adequate coverage. Remember that insurance companies value their customers and are often open to finding mutually beneficial solutions.

Live your healthiest life

Read my health-boosting wellness book, Life is Long

Think happier. Think calmer.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.

One last step!

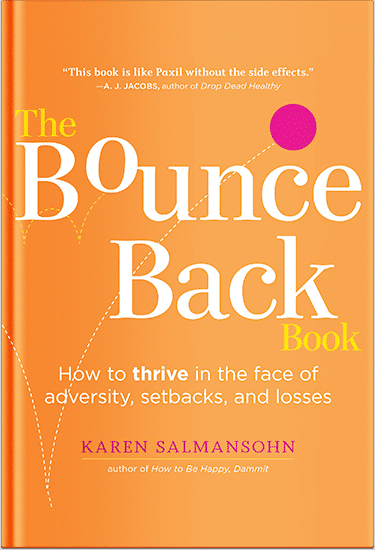

Please go to your inbox and click the confirmation link we just emailed you so you can start to get your free weekly NotSalmon Happiness Tools! Plus, you’ll immediately receive a chunklette of Karen’s bestselling Bounce Back Book!

Insurance serves as a safety net, offering financial protection and peace of mind in times of uncertainty. However, the cost of insurance premiums can often strain our budgets.

Insurance serves as a safety net, offering financial protection and peace of mind in times of uncertainty. However, the cost of insurance premiums can often strain our budgets.