Here’s a helpful guide to understanding low-risk investments, so you can grow your money while playing things safe.

Investing is like attending a world-class magic show. It’s full of tricks and illusions with promises of making your money grow right before your very eyes. But what if you prefer being more of a spectator rather than taking part?

No worry! There’s enough room in financial theater for all!

A Helpful Guide to Understanding Low-Risk Investments

If your stakes can remain as low as the chance of an illusion gone awry, this blog’s here for you.

Government Bonds: the Magic Wand of Investments

Government bonds can be an ideal way for the cautious investor to build wealth over time. When you purchase one, you are effectively lending money directly to the government in exchange for receiving interest payments at a set rate over an agreed-upon timeframe. It’s much like receiving thank-you notes in return!

These low-risk and reliable instruments don’t promise sky-high returns like some investments might. You can just relax and watch as your wealth steadily accumulates.

Gold: the Golden Snitch of Investments

Ah, gold – the “golden snitch” of investments! Shiny and luxurious while remaining low risk investment vehicle. It’s just like in Quidditch it holds great value and sought-after by many investors.

Gold has an intriguing quality. It does not follow the ups and downs of the stock market as closely. When stocks drop, gold tends to gain, offering your portfolio some protection from dramatic market shifts.

Unlike its volatile counterpart, however, gold doesn’t experience sudden shifts or dramatic fluctuations like other assets do. Gold investment can be like riding on an ever-evolving broom ride in search of that golden snitch. So if you’re seeking relief from the stock market’s wild Quidditch match, gold may be your solution.

And don’t think investing in gold requires owning individual coins; rather, invest through mutual funds or exchange-traded funds (ETFs) instead – and catch that golden snitch without getting your hands dirty!

Certificates of Deposit (CDs): the Safety Net

Our investment journey continues with Certificates of Deposit (CDs), the’safety net’. Imagine CDs as that protective barrier beneath a high wire at a circus! As reliable investments go, CDs may not offer much excitement. Yet their reliability makes life simpler. When investing in one, you commit your funds for an agreed period (say six months, one year or five).

Banks offer trustworthy strongman-like assurances of return when the term ends with interest payments that don’t seem excessive compared to savings accounts. Typically more so, even. CDs are federally insured up to $250,000, making them an appealing, low-risk choice.

Their main drawback? Withdrawals before term end incur a penalty. But after all, safety nets should be used as intended – for safety not thrills! So if you want a steady performance without heart palpitations then CDs might just be your ticket into investment circus!

Money Market Accounts: The Invisible Hand of Finance

Now, let’s pull back the curtain and reveal Money Market Accounts as the Invisible Hand of Finance. Think of them like magicians of finance. These accounts offer all of the conveniences associated with regular savings accounts. But with added special touches that make them truly exceptional.

These magical banks provide higher interest rates and come complete with check writing and debit card privileges. But they come with strings attached. Their minimum balance requirements are typically higher. And transactions per month can be limited.

As with CDs, MMAs are insured by the federal government – offering another safe haven for your savings. They might not bring riches out of thin air. But for low-risk investments that consistently perform, MMAs could be just what’s needed.

Dividend Yield Stocks: Finance’s White Rabbit

Prepare to explore Dividend Yield Stocks, finance’s white rabbit.

These investments offer investors more income through dividend payments compared to growth-focused stocks – providing significant portions of profits as dividends to shareholders each quarter.

One simpler way into the stock market is to buy shares of the company you work for. Companies such as Telstra offer shares for employees to buy and sell. If you own Teslstra shares, learn how to sell telstra shares here.

Simply put, stock market kings and queens act like generous monarchs distributing wealth amongst loyal subjects (read: investors). Their stocks often come from profitable companies that have a proven record of distributing regular dividends.

It’s simple: Just buy and hold on to stocks until they begin paying out at regular intervals. There may still be risk involved though. Even though these companies have proven their stability over time, the stock market can often be unpredictable! Dividend payouts can help ease some of the ups and downs of investing, making the journey less dramatic. Remember: in investments, slow and steady often wins the race!

Mutual Funds: A Mad Hatter’s Tea Party

Welcome to the Mad Hatter’s Tea Party where all financial instruments converge for one big party of mutual funds! Each one brings something different and adds its unique flavor. We all come together in celebration!

Mutual funds are pools of funds collected from multiple investors for investment purposes in securities like stocks, bonds, money market instruments or similar assets. Mutual funds offer small investors access to professionally managed portfolios of stocks, bonds and other securities which would otherwise be difficult and costly for them to put together themselves.

Imagine trying to host a tea party all by yourself without the Mad Hatter’s assistance and connections. What would be your risk factor then? Mutual funds tend to provide greater diversification while remaining subject to market risk.

At Mad Hatter’s table, tea is always worth its adventure! And with mutual funds, you can enjoy this party without being burdened with managing every detail – it’s like having your cake and eating it too!

Real Estate: the Emperor’s New Land

Let’s head into a land ruled by bricks and mortar: Real Estate. If you’re seeking to establish your investment portfolio here is perhaps your chance – investing can start as simply as purchasing rental property!

As opposed to stocks, real estate is a tangible asset that you can touch, see and show off at dinner parties. Plus, it gives you pride of ownership. In effect becoming the Emperor of this land!

But remember: even Emperors must exercise care. Your new kingdom presents many risks, such as property damage, unpredictable market fluctuations and possible vacancies. However, with careful planning and selections, real estate can offer steady income streams and long-term appreciation potential. After all, they don’t make any more land! Don’t wait. Claim the Emperor’s new land today and start your real estate adventure today!

Low-Risk Investments: The Final Act

From savings accounts and CDs, to mutual funds and finally real estate investments – investing is truly diverse and engaging! As with any journey, investing has its share of risks and rewards. With patience, courage and an experienced guide by your side you too can navigate this whacky sea called investing successfully. Fortune favors bold investors while wisdom leads. Until our next blog post adventure together – may your investments be fruitful and returns high!

Get Support To Relieve Anxiety

Explore the therapist recommended audio and video course: The Anxiety Cure.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think happier. Think calmer.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.

One last step!

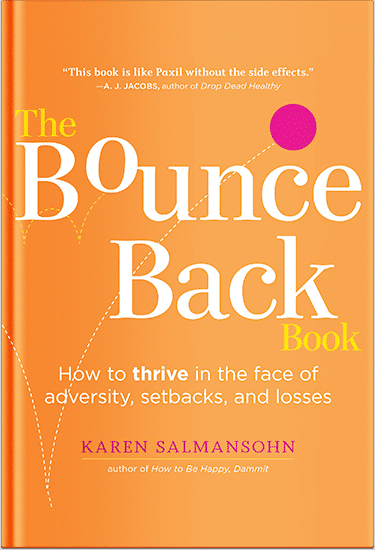

Please go to your inbox and click the confirmation link we just emailed you so you can start to get your free weekly NotSalmon Happiness Tools! Plus, you’ll immediately receive a chunklette of Karen’s bestselling Bounce Back Book!