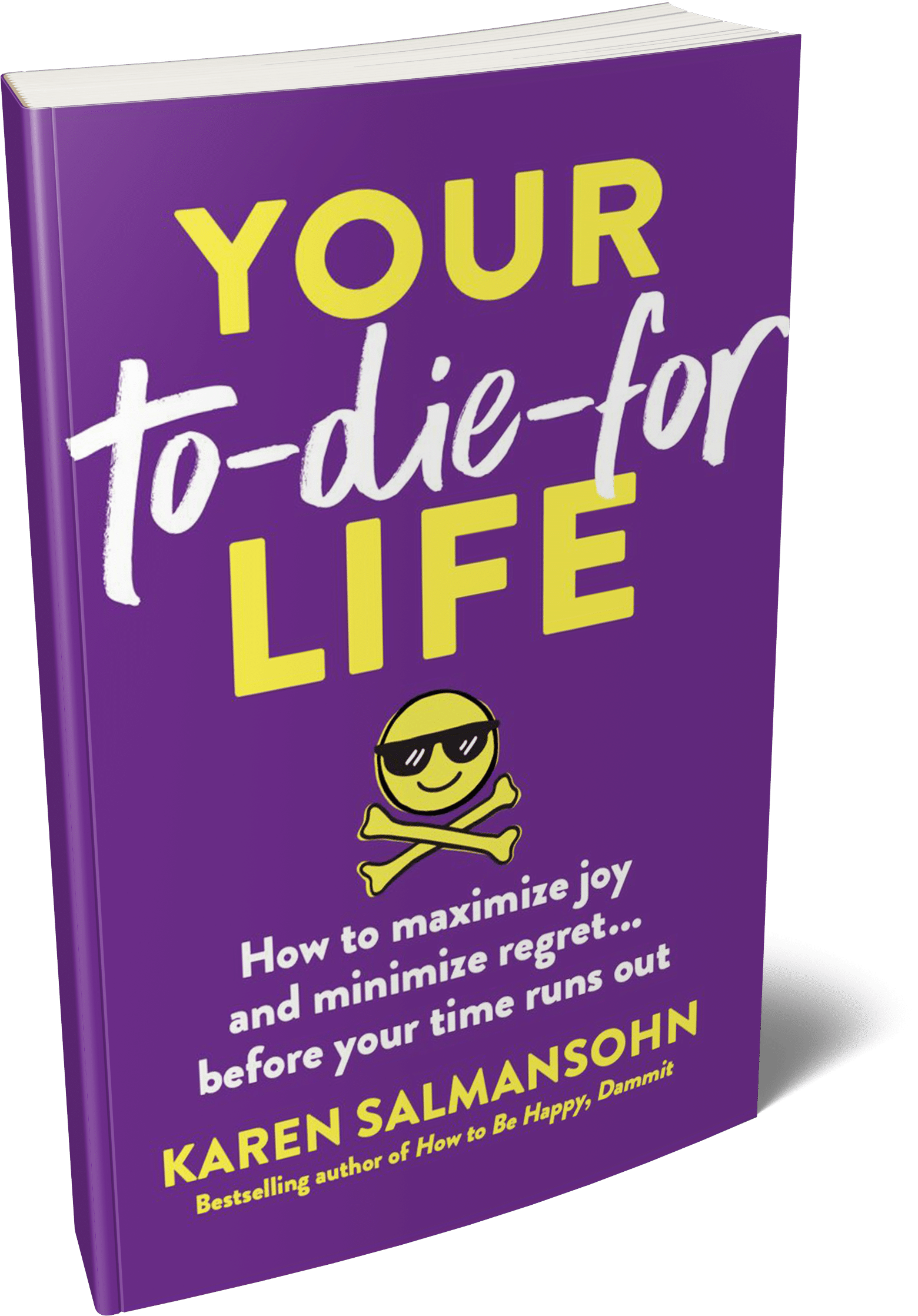

Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

Inflation in the United States has recently reached a rate of 6.5%. This is more than the average inflation rate of 3.8% per year.

Inflation in the United States has recently reached a rate of 6.5%. This is more than the average inflation rate of 3.8% per year.

If you haven’t given much thought to how you’ll deal with inflation, it’s important to start thinking about budgeting strategies now. Making some tweaks to your budget can help you cope with inflation and avoid major disruptions to your family’s lifestyle.

Fortunately, I’m here to be your guide to help you to spend money on a budget – without breaking the bank.

If you’re familiar with my work, then you know I’m an award winning designer. I love creating books and video courses, which help people to live their happiest and most successful live.

So I created this simple guide with ways to refresh your home on a budget to help your family handle their finances during times of inflation.

Read on to learn how to grow your money – not deplete your money – during challenging financial times.

One of the first steps that you should take to keep your family financially stable during inflation is to take stock of your current spending.

It’s important to track your spending for a couple of weeks to get a clear picture of what you’re spending money on regularly. You should also take a closer look at how much income is coming in as well.

After you do this, you can then start creating a budget and figuring out where you can cut some things out or reduce certain expenses. Chances are there are some ways that you’re overspending money currently.

Based on the information you have about your current spending, you can create a simple budget. This will allow you to have more control over your finances while still getting everything that’s essential for you and your family.

Another budgeting method to remember during inflation is to always look for great deals. Be sure to reevaluate all of your spending habits and look for ways to cut costs.

Chances are that you could do some more comparison shopping to find good deals when grocery shopping or when buying other essentials for your family. It’s a good idea to always compare prices to make sure that you’re getting items for the lowest prices possible.

In addition to this, make sure that you’re making use of any discounts that are available. You may want to consider using more coupons and special offers when buying groceries, eating out, or buying any essentials that you need. Along with coupons, you can also bulk buy food items that you consume a lot of, to save costs in the long run.

While reducing your spending and following a budget can go a long way, sometimes it’s necessary to get additional income as well.

Looking for ways to raise your income such as taking another part-time job or simply doing some side gigs can be helpful. Consider looking for a side hustle that you can use to make your family finances a little bit more secure to cope with inflation. For example, explore my online program Make Profitable Courses Without The Overwhelm.

Selling crafts on Etsy, becoming an Uber driver, renting a room in your home, or doing another gig can be well worth it if you want to feel more financially stable. Additionally, you may also want to learn how to benefit from inflation as well.

While dealing with inflation can be tough, these budgeting methods and tips can help. Understanding your spending, looking for deals, and raising your income are some useful ways to budget to make inflation easier to handle.

Eager to find more helpful tips? Find more useful lifestyle articles here.

Explore my research based video course on relaxation: The Anxiety Cure.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.