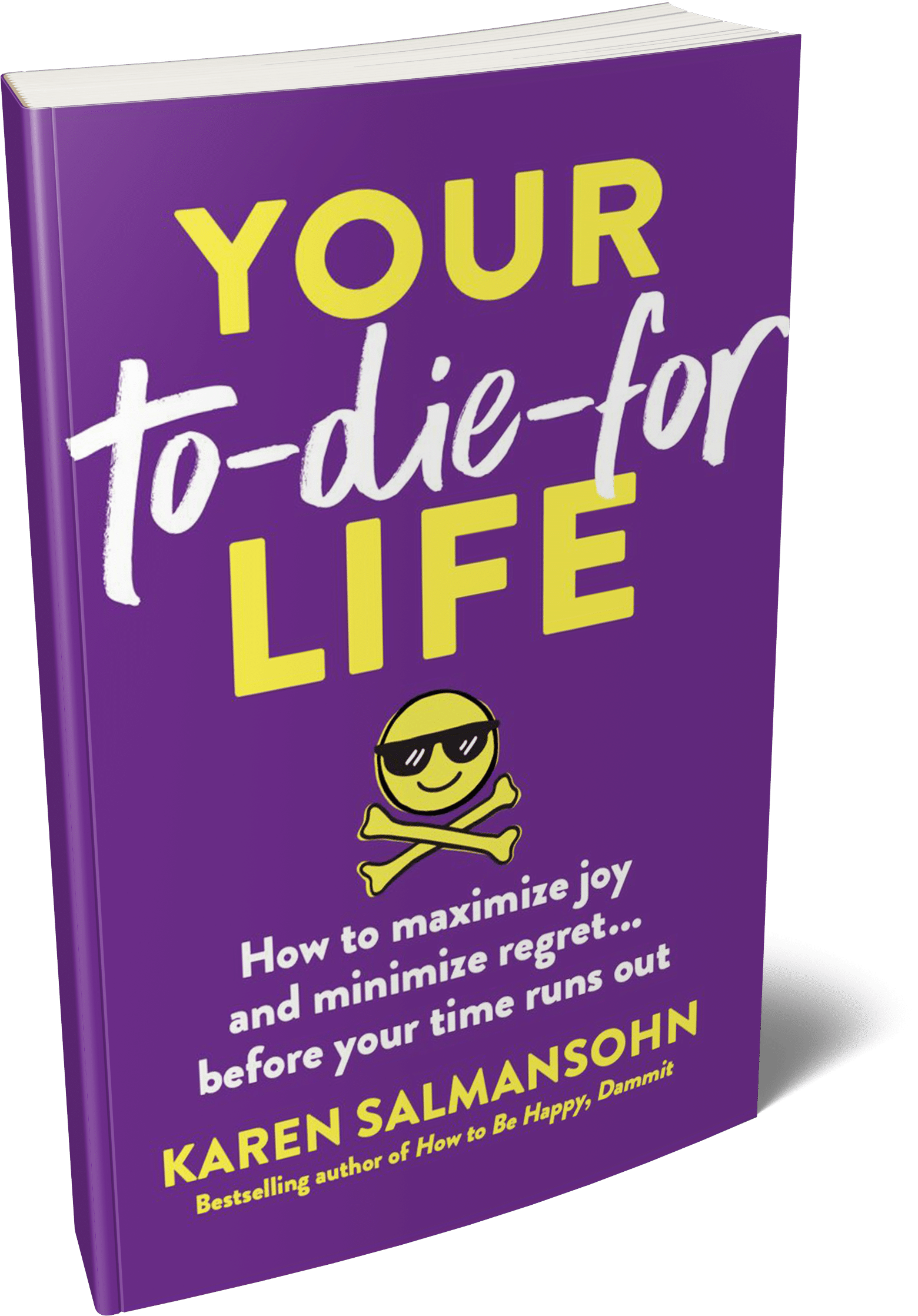

Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

If you want to be mindful of money, here’s how to get your insurance policy with a low rate so you’re protected without spending a fortune.

If you want to be mindful of money, here’s how to get your insurance policy with a low rate so you’re protected without spending a fortune.

Insurance is handy for protecting you from the financial fallout of unforeseen disasters, whether that might be a health emergency, a car accident, a domestic damage dilemma or anything else in between.

Of course the cost of insurance is a bit of a bugbear for many customers. But with the right approach you can drive down the price you pay for your premiums and reap the benefits.

As you might know, I’m a Peak Performance Coach, helping people to live their lives at their highest potential.

So I put together this helpful article, with recommended ways to get a low rate when you renew your insurance policy.

The biggest mistake you can make is to assume that the current insurance deal you are on is the best one out there. Or you can assume that it is difficult to make the switch, and that this will outweigh any potential savings.

In reality, with online comparison tools such as PolicyScout, you can get quotes from top insurers across a huge range of cover, from life insurance and home insurance to pet insurance and beyond.

There are literally hundreds of insurers toting thousands of different products to compare. And rather than having to do this manually, modern tools let you call up competitive quotes in seconds.

If a low rate is all you care about, then bargain prices abound. But you can also get tailored policies. These represent value for money while still featuring the level of cover you need. Yes, it really is that flexible and simple.

Insurance is all about providers taking a calculated risk. And obviously if they know that they will not have to pay out as much even if a customer does make a claim, then the cost of the cover itself will be able to come down.

You can do this by boosting your deductible. This is essentially the amount you agree you’ll have to pay when a claim is made.

Obviously you will be staring down the barrel of a bigger bill if the worst happens and you develop a medical condition. But to offset this you’ll have lower monthly or annual premium costs to consider, which might make it worthwhile.

It’s often possible to get cheap insurance by having policies with multiple providers. However, sometimes it will be more affordable to put all of your eggs in one basket and get a bundle deal from a single brand, like this Littleton Colorado Insurance Broker.

Keep in mind, lots of insurers have policies which combine life insurance and home insurance. And you can add auto insurance into the mix as well.

Again, comparison is your friend here, as a little research could save you a packet, and not all bundle deals are better value than their separated equivalents. But in the right circumstances, combined insurance products can make a lot of sense.

Depending on the type of insurance, you can make changes to secure savings. Let’s take auto insurance as an example; one of the factors that impacts cost is your credit rating, so taking steps to improve your score will open up the potential for sizable discounts.

Likewise the type of car you drive makes a difference. For example, sportier, less safe models are seen as risky prospects by insurers. Meanwhile, low powered family cars are comparatively cheap to insure.

In short, don’t simply sit back and accept that your insurance is going to cost you an inordinate amount. Instead, be proactive in seeking out affordable insurance. Be sure to leverage the tools at your disposal online. Plus you should look into the changes you can make in your own life, to keep this as cost-effective as possible.

Hire me to be your 1-on-1 Peak Performance Coach.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.