If you’re living a healthy lifestyle and wonder what happens if you outlive your term life insurance, read on to find out!

As you might know, permanent life insurance ensures security throughout your entire life.

But term life insurance, on the other hand, could leave you hung in the middle if you have managed to stay alive, and the insurance is nearing its expiration date.

So, you might wonder what happens if you outlive your term life insurance!

I’m sharing about this topic today, because I’m the bestselling author of a health-boosting longevity book, Life is Long..

In my book I share how to protect your health with research based health information.

I write a lot about science-backed tips and wellness strategies for living healthier, younger, longer.

My mission: I want to live to 100 – and inspire others to as well.

In this article I thought we’d explore what would happen if you take such awesome care of your health, that you not only don’t have pre-existing medical conditions, you also wind up outliving your Term Life Insurance!

In fact, you might wonder if there was a possible way to get the paid premium back. However, life insurance policies only cover you in case of death. And so there is no money-back scheme for you to get the paid premium returned.

Unless the insured has passed away while the policy was still active, the amount accumulated over time would stay within the bank and made available to the unfortunate ones.

Unlike permanent life insurance, term life insurance is available for a limited period of time, which is meant to end.

Hence, certain questions arise when you realize your life insurance has come to an end, and you have been lucky enough to have been blessed with good health throughout its term.

Why Did You Get The Insurance In The First Place?

It is essential to understand the reason you took the term life policy. Perhaps you had an ongoing mortgage along with children to take care of, and the policy would have ensured debts get paid while children could continue growing without the money crunch.

Well, things might have changed by now.

That was in the past. And now you have yourself taken care of the mortgages, debts, and financial aid required by children.

Re-establishing the need for a life insurance policy would allow you to think rationally. You can now decide on getting either a fresh life insurance policy or extending the current one. Or even better, making peace with the insurance expiry.

Is There A Way To Get The Premium Paid Back?

In very rare cases, you might get the option of ROP, i.e., Return of Premium.

For instance, you have outlived your Term life insurance. And as a result, you could choose to get the paid premium returned.

The only downside to ROP is the fact that you end up paying higher premiums as compared to a regular Term life insurance policy.

We encourage you to take time to identify your need and related factors. And then afterwards, decide on whether you would like to bear this extra cost or not.

Best Options When Term Life Insurance Is Expiring

Consider Renewal To Extend Benefits

You can explore this option – which is commonly offered by insurance companies. Basically, you might want to extend the term of your life insurance policy. However, if you do, then you would be required to pay a higher premium.

For instance, let’s say you took the policy 30 years ago. Now you have turned 70. You are at higher risk considering the old age. As a result, the insurance companies would require you to pay a higher amount than previously.

On the brighter side, you will be excused from undergoing a medical examination. The renewal is an excellent choice if you have children dependent on you. Or, if due to some unfortunate events, you have not yet managed to clear the debts.

A New Policy Might Take Some Burden Off

If you are less than 70, comparatively younger, and consider yourself healthy, we recommend going on shopping. Gather information regarding suitable term life insurance policies. Seniorslifeinsurancefinder.com is the best source for you to find an affordable but trusted insurer.

Before settling on a plan, we encourage you to figure out whether you have future expenses or have settled the due amount. If you still have children living with you or they have grown to be independent.

Such clarifications would come in handy when making a decision and allow you to select a relevant Life Insurance policy plan.

Having said, you would certainly be required to go through the medical examination, and records would be taken into consideration by the insurance companies, prior to getting you onboard with a new term.

Converting To Permanent Life Insurance Is Not A Bad Idea Either

Yes, you’ve heard it right! Another way to continue feeling secured despite your term insurance coming to an end is by converting it to permanent life insurance. Term life insurance is cheaper and hence, is popular amongst individuals in their early 30s.

However, if you are older, a permanent life insurance policy would take a lot of burden off the shoulders.

Another associated benefit of permanent life insurance is that it allows you to withdraw money from the accumulated sum over time.

We recommend withdrawing only in the time of emergency to ensure your loved ones get the entire amount in the case that you die.

You need not go through medical examination again; however, the premium is likely to be higher since you are converting a term life insurance to permanent.

Converting to permanent is ideal when you think you might not be eligible for a new policy, given the recent troubled health.

Make Peace With The Ending Of Your Term Life Insurance

Now that you are older and wiser, we assume you have your finances figured out, and there might not really be a need to provide security to the family, which comes precisely from the Life insurance policy.

Who knows, you have better ways laid ahead to have your family covered if you happen to meet with uncertain death. Whatever may be the situation, re-consider the options mentioned above.

We recommend thinking clearly as well as rationally to make a suitable plan of action even if that means making peace with your term insurance nearing its end!

Conclusion on Outliving Your Term Life Insurance

It is very common to let the thought of life insurance policy ending scare you or, perhaps, make you restless.

However, your current financial condition and all the measures that you took to secure your family are to be considered before panicking.

You might not even need the same sense of security now as you did earlier because you have got your children to handle their affairs independently.

There may not be a debt on your head anymore. Or, in worse case scenarios, you are exactly where you were 20 years ago. In any of the presented scenarios, there is definitely a way out.

Live your healthiest, longest life

Read my bestselling health-boosting book, Life is Long.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think happier. Think calmer.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.

One last step!

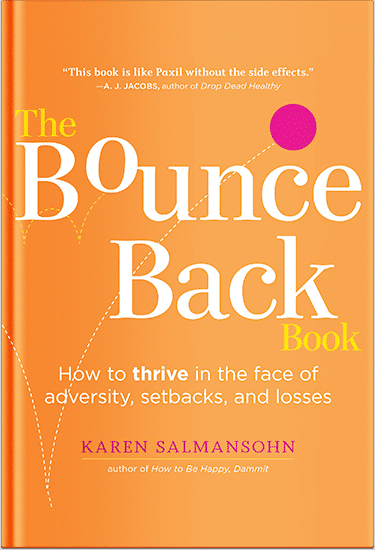

Please go to your inbox and click the confirmation link we just emailed you so you can start to get your free weekly NotSalmon Happiness Tools! Plus, you’ll immediately receive a chunklette of Karen’s bestselling Bounce Back Book!