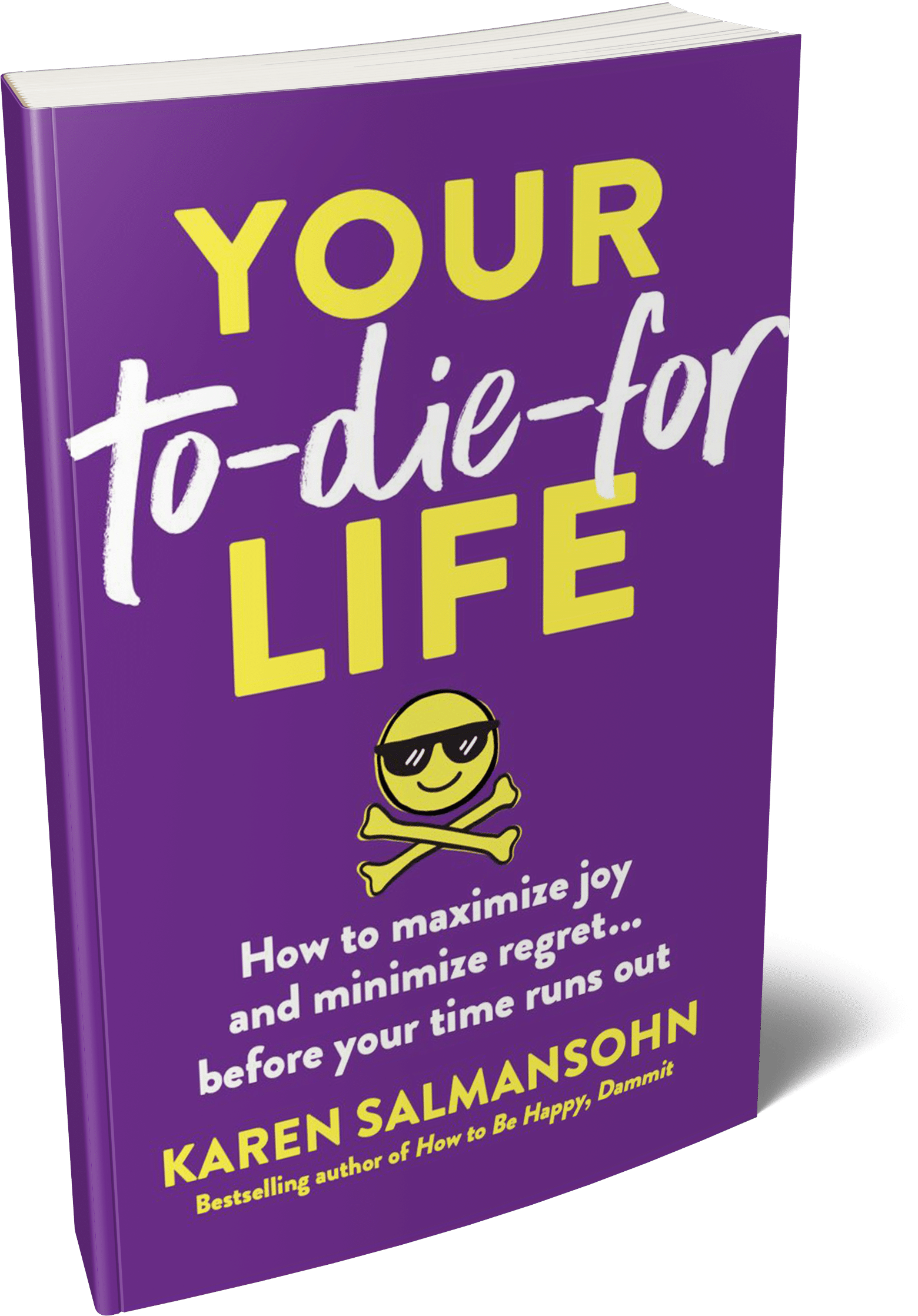

Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

Estate planning is often seen as a daunting task, but it doesn’t have to be. With the right guidance, families can secure their futures and ensure that their loved ones are taken care of. Law firms play an essential role in making this process smooth, efficient, and less stressful. From drafting wills and trusts to offering personalized advice, lawyers bring both expertise and empathy to the table.

Estate planning is often seen as a daunting task, but it doesn’t have to be. With the right guidance, families can secure their futures and ensure that their loved ones are taken care of. Law firms play an essential role in making this process smooth, efficient, and less stressful. From drafting wills and trusts to offering personalized advice, lawyers bring both expertise and empathy to the table.

If you’re wondering how firms like Turner Freeman and other experienced legal practices simplify estate planning, this article will walk you through the essential services and benefits they provide.

Estate planning isn’t just for the wealthy—it’s a necessity for anyone who wants to protect their family and assets. Whether you have a sprawling estate or a modest home, a well-structured plan ensures your wishes are honored. Without one, families often face lengthy legal battles, confusion, and emotional strain.

Lawyers understand the complexities of estate laws and can tailor solutions to meet a family’s unique needs. Their guidance ensures that everything—from financial assets to sentimental heirlooms—is handled according to your wishes.

When people think of estate planning, the first thing that comes to mind is a will. While a will is a cornerstone of estate planning, it’s just one piece of the puzzle. Law firms help families navigate a range of legal tools, such as:

A will outlines how your assets should be distributed after your death. Lawyers help ensure your will is legally valid, comprehensive, and free from loopholes that could lead to disputes.

Trusts go a step further by offering more control over how and when assets are distributed. For instance, parents might set up a trust to manage their children’s inheritance until they reach a certain age. Lawyers can recommend the best type of trust for your needs, whether it’s a revocable trust, irrevocable trust, or special needs trust.

This document allows someone to make financial or medical decisions on your behalf if you’re unable to do so. A lawyer ensures that this power is granted to a trusted individual and is aligned with your preferences.

These documents outline your wishes for medical care in the event you cannot communicate them. They relieve families of the burden of making difficult decisions during emotional times.

Estate taxes can eat into the value of your estate. Lawyers provide strategies to minimize tax liabilities, ensuring more of your assets go to your loved ones.

The legal intricacies of estate planning are often overwhelming for families to tackle alone. A lawyer simplifies the process by:

Estate laws vary by jurisdiction and can be confusing. A qualified lawyer ensures that your documents comply with local regulations and reflect your unique situation.

Every family is different. A lawyer listens to your concerns, understands your goals, and crafts a plan that addresses your specific needs.

Planning for the future involves tough conversations about mortality, finances, and family dynamics. Lawyers act as neutral third parties, facilitating discussions and helping families avoid conflict.

Life changes—marriages, divorces, births, and deaths all impact your estate plan. A lawyer keeps your documents up to date, ensuring they evolve with your circumstances.

Why should you rely on a law firm instead of tackling estate planning on your own? Here are some key benefits:

DIY estate planning kits might seem cost-effective, but they often lead to errors or omissions. A lawyer ensures that your plan is airtight and minimizes the risk of future disputes.

If you have young children or dependents with special needs, a lawyer can structure a plan to provide for them without jeopardizing government benefits or creating unnecessary burdens.

The process of drafting legal documents, understanding laws, and managing paperwork is time-consuming. Lawyers streamline the process, allowing you to focus on what matters most—your family.

Perhaps the most significant benefit is the peace of mind that comes with knowing your loved ones will be cared for. Lawyers ensure your wishes are clear, enforceable, and thoughtfully planned.

One of the most challenging aspects of estate planning is addressing family dynamics. Disputes can arise over inheritance decisions, especially when emotions run high. Lawyers help families navigate these sensitive issues by:

For example, a lawyer might suggest creating a trust to distribute assets gradually rather than in a lump sum, reducing the risk of disputes among siblings.

It’s never too early to start estate planning. While many people put it off, life’s unpredictability makes early planning essential. Here are some milestones that should prompt families to consult a lawyer:

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.