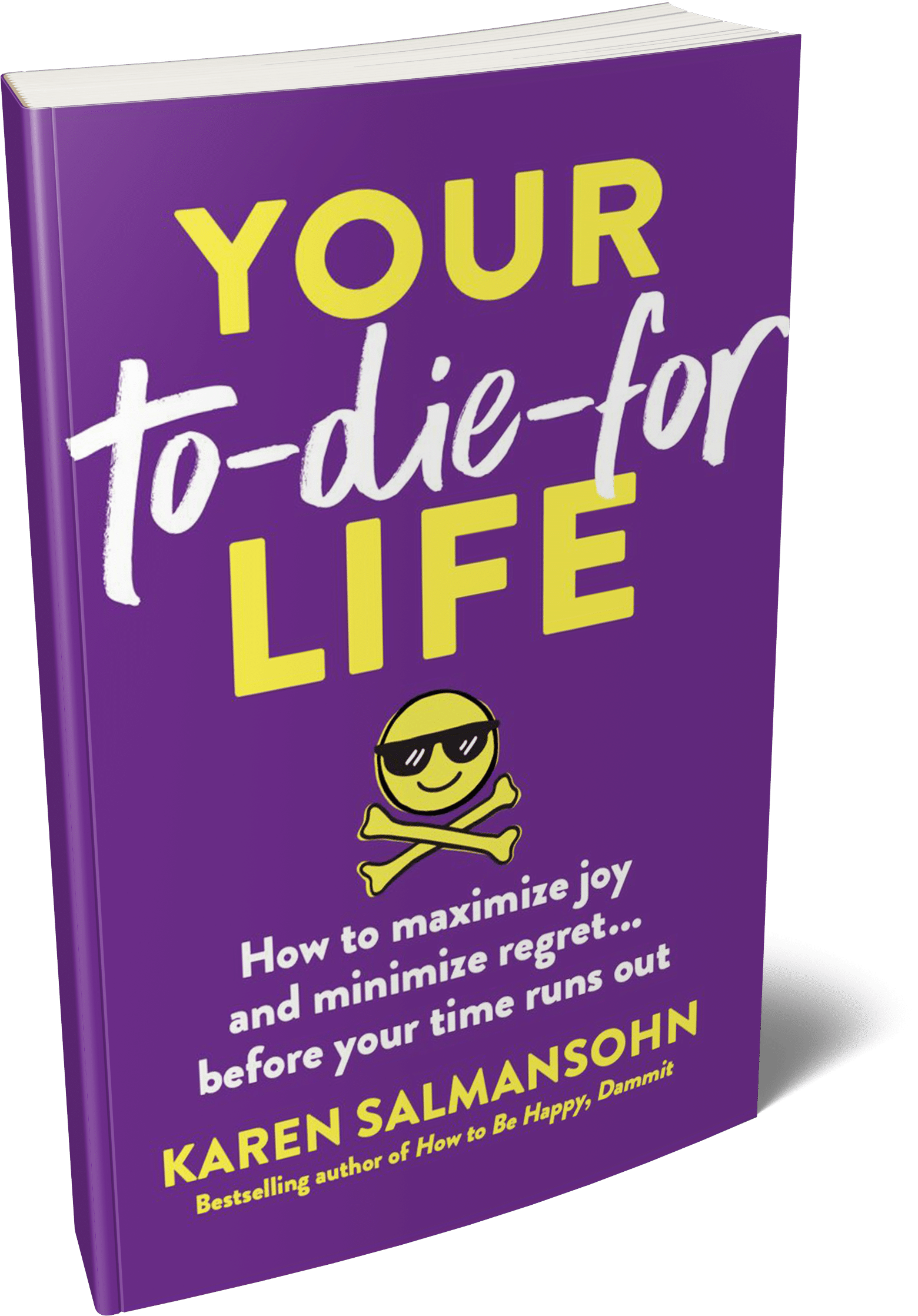

Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

In the dynamic and complex world of finance, the importance of qualified and competent financial advisors cannot be overstated. With individuals and businesses alike relying on financial advisors for sound advice and strategic planning, ensuring that these financial professionals are equipped with the necessary skills and knowledge is critical.

In the dynamic and complex world of finance, the importance of qualified and competent financial advisors cannot be overstated. With individuals and businesses alike relying on financial advisors for sound advice and strategic planning, ensuring that these financial professionals are equipped with the necessary skills and knowledge is critical.

One critical regulatory framework in Australia that aims to uphold the standards of financial advisors is rg146. This blog post delves into the role of RG146 in enhancing the qualifications of financial advisors and ensuring that they provide high-quality services to their clients.

RG146, or Regulatory Guide 146, is essential to the Australian Securities and Investments Commission (ASIC) regulations. Introduced in 1999, RG146 sets out the minimum training standards for financial advisors. It mandates that individuals who provide financial product advice to retail clients must meet specific educational requirements, ensuring they possess adequate skills and knowledge to offer competent and reliable advice.

To meet RG146 requirements, financial advisors must complete specific courses and obtain relevant qualifications. These components cover a broad range of knowledge areas essential for providing sound financial advice. Key areas include:

Achieving RG146 compliance involves several steps. Prospective financial advisors typically follow this path:

RG146 plays a vital role in enhancing the qualifications of financial advisors in Australia. Setting rigorous educational and training standards ensures that advisors possess the necessary skills and knowledge to provide high-quality financial advice. This protects consumers and maintains the integrity and credibility of the financial advisory industry. For financial advisors, achieving and maintaining RG146 compliance is essential for career success and delivering the best possible service to their clients. As the financial landscape evolves, RG146 will remain a cornerstone of the industry’s commitment to excellence and professionalism.

Explore my bestselling and therapist recommended audio and video course: The Anxiety Cure.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.