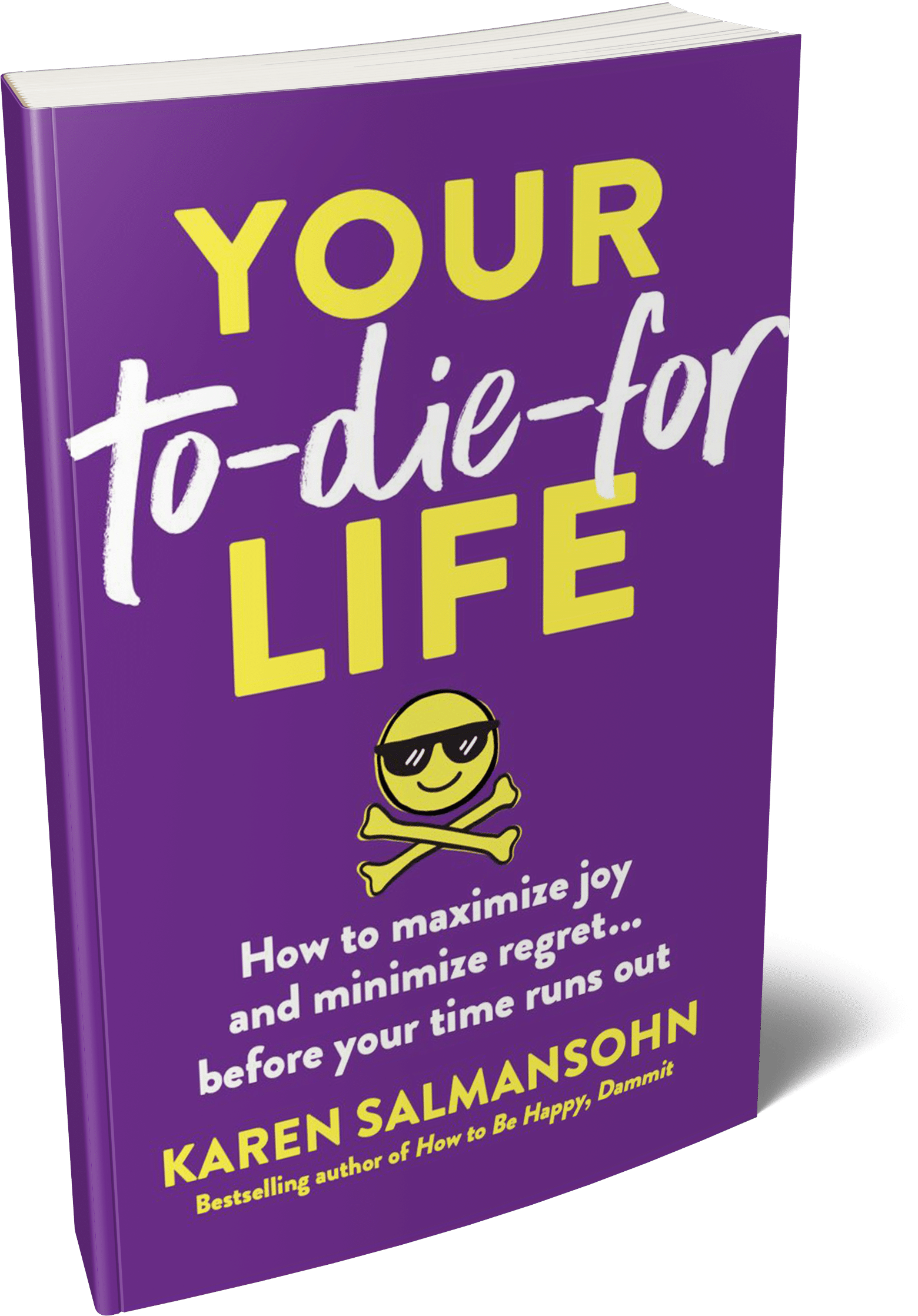

Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

In today’s fast-paced financial markets, traders are constantly seeking ways to gain an edge over their competitors. One of the most promising developments? In recent years there’s been an integration of machine learning techniques and algorithmic trading strategies into the modern trader’s toolkit.

In today’s fast-paced financial markets, traders are constantly seeking ways to gain an edge over their competitors. One of the most promising developments? In recent years there’s been an integration of machine learning techniques and algorithmic trading strategies into the modern trader’s toolkit.

As algorithmic trading gains popularity, it is becoming more accessible to retail traders. Especially when it’s combined with some forex brokers no minimum deposit requirements.

The democratization of these advanced trading techniques allows a wider range of traders to benefit from the increased efficiency and reduced risk that they can offer.

I’m writing this article because I want to do what I can to make trading easier for people.

As you might know, I am a bestselling author with about 2 million books sold globally.

Plus I created a program to help entrepreneurs to make money online called Make Profitable Courses Without The Overwhelm.

I love sharing insights and strategies to help people to become more successful.

With this in mind I put together this quick guide with everything you need to know about machine learning and algorithmic trading.

In this guide, we will explore how you can incorporate these cutting-edge tools into your strategy, regardless of your account size or experience level.

Algorithmic trading, also known as algo or automated trading, involves using computer programs to execute trades in financial markets according to predefined rules. These rules can be based on various factors.

For example: technical indicators, market data, or even news events.

By automating the process, algorithmic systems can execute orders with greater speed and accuracy than human traders. This results in increased efficiency and reduced risk.

Machine learning, a subset of artificial intelligence, refers to the development of algorithms that enable computers to learn from and make predictions or decisions based on data. In the context of algorithmic trading, machine learning techniques can be used to analyze vast amounts of historical data. Plus it can identify patterns or trends that may predict future price movements. By incorporating these insights into trading algorithms, traders can potentially improve the effectiveness of their strategies. As a result, they achieve better results.

There are several machine learning algorithms that have gained popularity in algorithmic systems. Some of the most common ones include:

Linear regression is a simple algorithm that models the relationship between input variables and output variables by fitting a linear equation to observed data. In algorithmic trading, it can be used to predict future prices based on historical data.

Decision trees are a type of machine learning algorithm that can be used for both classification and regression tasks. They work by recursively splitting the input data into subsets based on certain conditions, ultimately leading to a prediction. In algorithmic trading, decision trees can be used to create rules based on historical data and market conditions.

SVM is a supervised learning algorithm that can be used for classification or regression tasks. It works by finding the hyperplane that best separates the data into different classes or predicts the target variable. In algorithmic trades, SVM can be used to predict price movements or classify market conditions.

Neural networks are a type of machine learning algorithm inspired by the human brain. They consist of interconnected layers of nodes, with each node processing information and passing it on to the next layer. Neural networks can be used for various tasks.

For example: pattern recognition, forecasting, and decision-making.

They can also be used to predict future price movements. Or they can identify trading opportunities based on market data in algorithmic trades.

Reinforcement learning is a type of machine learning where an agent learns to make decisions by interacting with its environment and receiving feedback in the form of rewards or penalties. In algorithmic trade systems, reinforcement learning can be used to optimize trading strategies. How? By continuously adjusting parameters and learning from past performance.

Before implementing a machine learning-based algorithmic trading strategy, it is crucial to evaluate its performance using historical data.

Before implementing a machine learning-based algorithmic trading strategy, it is crucial to evaluate its performance using historical data.

This process, known as backtesting, can help traders identify potential issues and fine-tune their strategies before deploying them in live markets.

There are several backtesting methodologies that can be used, including:

There are several tools and platforms available for developing, backtesting, and implementing machine learning-based algorithmic trading strategies. Some popular options include:

By incorporating machine learning techniques and algorithmic trading strategies into your trading approach, you can potentially gain a competitive edge and improve your overall performance in the financial markets. It’s important to understand popular algorithms, backtesting methodologies, and available tools to develop and implement effective strategies that help you use the power of modern technology to achieve your trading goals.

Explore my money making online program called Make Profitable Courses Without The Overwhelm.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.