Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

How can you decide what level of health insurance to get? Answer the key questions in this article get the guidance you seek!

How can you decide what level of health insurance to get? Answer the key questions in this article get the guidance you seek!

During the months of October and December, the annual open enrollment period is well underway. And, chances are you are in the stressful process of purchasing, renewing, or upgrading your health insurance policy.

But this certainly isn’t a decision to be made in a rush or under pressure! After all, the insurance policy you choose will determine the level of care you’ll be able to access in months to come.

I’m sharing this info because I am bestselling wellness author.

I founded a nutritionist recommended online program called:

>>>The Stop Emotional Eating Course!

I love sharing insights and techniques to help people to enjoy their healthiest life.

So, how can you decide with confidence what health insurance to get? Answering the questions below can offer you the guidance you have been looking for!

One of the critical considerations to make before choosing medical insurance is whether you rely on in-network facilities and doctors for your everyday healthcare. And, in most cases, if you have a healthcare provider you already trust and respect, the best option is to choose a policy that will cover the services provided by a particular clinic.

In terms of coverage levels, don’t forget that PPO (preferred provider organization) and EPO (exclusive provider organization) policies don’t typically cover the services provided by out-of-network providers. If accessing in-network services is important to you, opt for HMO (health maintenance organization) or POS (point of service plan) plans instead.

While there has never been so much choice in terms of insurance providers and policies, not all healthcare insurance plans are created equal. That is why comparing health insurance policies is one of the critical steps to take to find a suitable plan for your medical and financial needs!

Conditions and diseases such as heart disease, diabetes, mental disorders, epilepsy, obesity, and HIV affect over 51% of the US population. But, despite how common these conditions are, chronic and pre-existing conditions might still have an unexpected effect on your health insurance eligibility.

That is why, if you have one or more of the conditions below, you should look for an ad hoc insurance policy that will provide coverage for specialist visits, services, and prescription medications. Some options to customize your policy include investing in additional coverage for your employer-sponsored plan, opting for Medicare Advantage plans, and handpicking riders.

According to statistics by the Kaiser Family Foundation, employer-sponsored health insurance plans provide coverage for around 155 million nonelderly people in the US. so, if you are employed, the chances are that you will be able to take advantage of affordable or free health insurance for you and your family.

Nonetheless, it is important to consider that employer-sponsored plans are often standard and designed to only cover essential care needs. So, even if your employer offers health insurance coverage, you might look into the benefits of tailoring your coverage to your needs through add-ons or supplemental insurance.

The introduction of programs such as Medicare has helped millions of people across the US access high-quality coverage for medically-necessary healthcare services. In turn, one of the key questions to ask yourself is whether you qualify for Medicare.

Generally, this is an accessible option for individuals aged 65 and over or for people with disabilities. Depending on whether you are eligible for Part A or Part B, you will be able to take advantage of free or discounted services such as inpatient hospital care, prescription drugs, surgery, and home health care.

If you wish to access more specialist services (such as vision, hearing, or dental visits) you might consider the benefits of investing in supplemental coverage or Medicare Advantage plans.

If you are unsure about the best type of Health Insurance Card you should get… consider setting up a consultation with your healthcare provider or insurance broker. They can help you better understand how to best meet your medical needs.

Explore my nutritionist recommended online program >>>The Stop Emotional Eating Course!

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

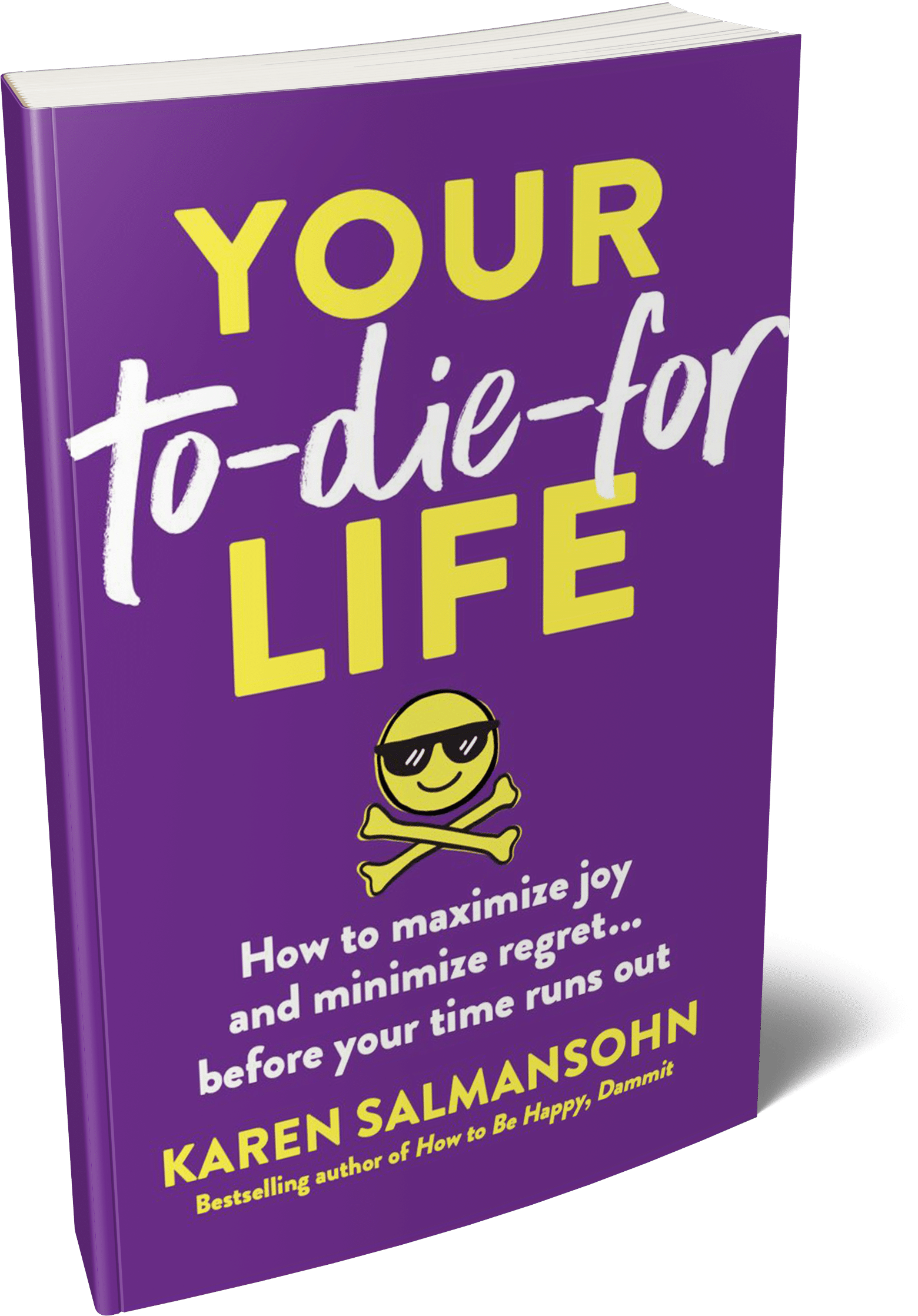

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.