Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

Planning for Healthcare costs in retirement has never been more important.

Planning for Healthcare costs in retirement has never been more important.

It only takes one glance at the current economy to realize just how difficult it can be to stay financially stable in today’s society, especially if you’ve recently retired.

Many people are aware that healthcare costs can often be one of the most cost-heavy aspects of life after retirement. As a bestselling wellness author, I’ve written about this topic of planning for retirement in my longevity book, Life Is Long.

As of 2021, a 65-year-old couple may require approximately $300,000 in savings to ensure their healthcare needs are accounted for. This is a conservative estimate, as healthcare costs can vary dramatically depending on several factors including where you retire, when you retire, and how long you live.

Additionally, this number does not even include the additional annual costs associated with long-term care. In 2020, long-term healthcare carried a median cost of $105,852 for needs like:

No matter how effective you were at saving throughout your working life, many people still don’t have the funds needed to live comfortably and healthily in retirement. No worries. I’m here to help.

Courtesy of our friends at MedicareInsurance.com, here are a few tips that can help you ensure you are prepared for medical costs in retirement.

When considering your retirement, the best thing you can do is take a “big picture” look at your overall retirement budget. Usually, this budget is heavily dependent on two factors:

Social security benefits are one such form of retirement income to factor in. Currently, the maximum monthly benefit of social security payments is $3,011 for those who retire at 65.

One vital expense to consider include the cost of living (expenses associated with food, transportation, and housing). The average cost of living for American retirees aged 65 and older amounts to about $4,328 per month on average.

It doesn’t take a math whiz to see the problem here.

In fact, with these statistics in mind, it should come as no surprise that only 51 percent of adults over the age of 60 believe they are financially prepared for retirement.

As we age, our bodies will naturally begin to age as well, often resulting in more need for medical treatment. On the other hand, those who live an especially healthy lifestyle will often see an increased cost of living as a result of living longer.

Chris Schaefer, head of the retirement plan practice at MV Financial, put it best:

“The healthier we are going into retirement typically means that less money will be allocated toward health care expenses. The other side of that coin is that with a healthier lifestyle, life expectancy will be longer and, therefore, retirees need to plan for a longer time in retirement.”

If this information seems frightening, don’t worry. You may be pleasantly surprised to hear that there are many ways to adequately prepare for medical costs in retirement.

Medicare, the government-regulated health insurance program designed specifically for retirees and those diagnosed with certain illnesses or disabilities, is currently the gold standard when it comes to managing healthcare costs as a senior.

There are Medicare Parts A and B, which make up what is known as “Original Medicare.”

Original Medicare covers the most basic health care needs for seniors, for a small fee, such as:

However, the most comprehensive form of Medicare is Medicare Part C, also known as a Medicare Advantage.

Medicare Advantage is required by law to offer the same level of coverage as Original Medicare. But these plans often include even more comprehensive healthcare coverage, including coverage for:

Believe it or not, these plans can often be had for $0 premiums. Want to learn more about Medicare Advantage and how it may be able to help you budget your expenses in retirement? Simply ask a Medicare Advantage expert or a licensed insurance agent.

Explore my research based video course: The Anxiety Cure.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

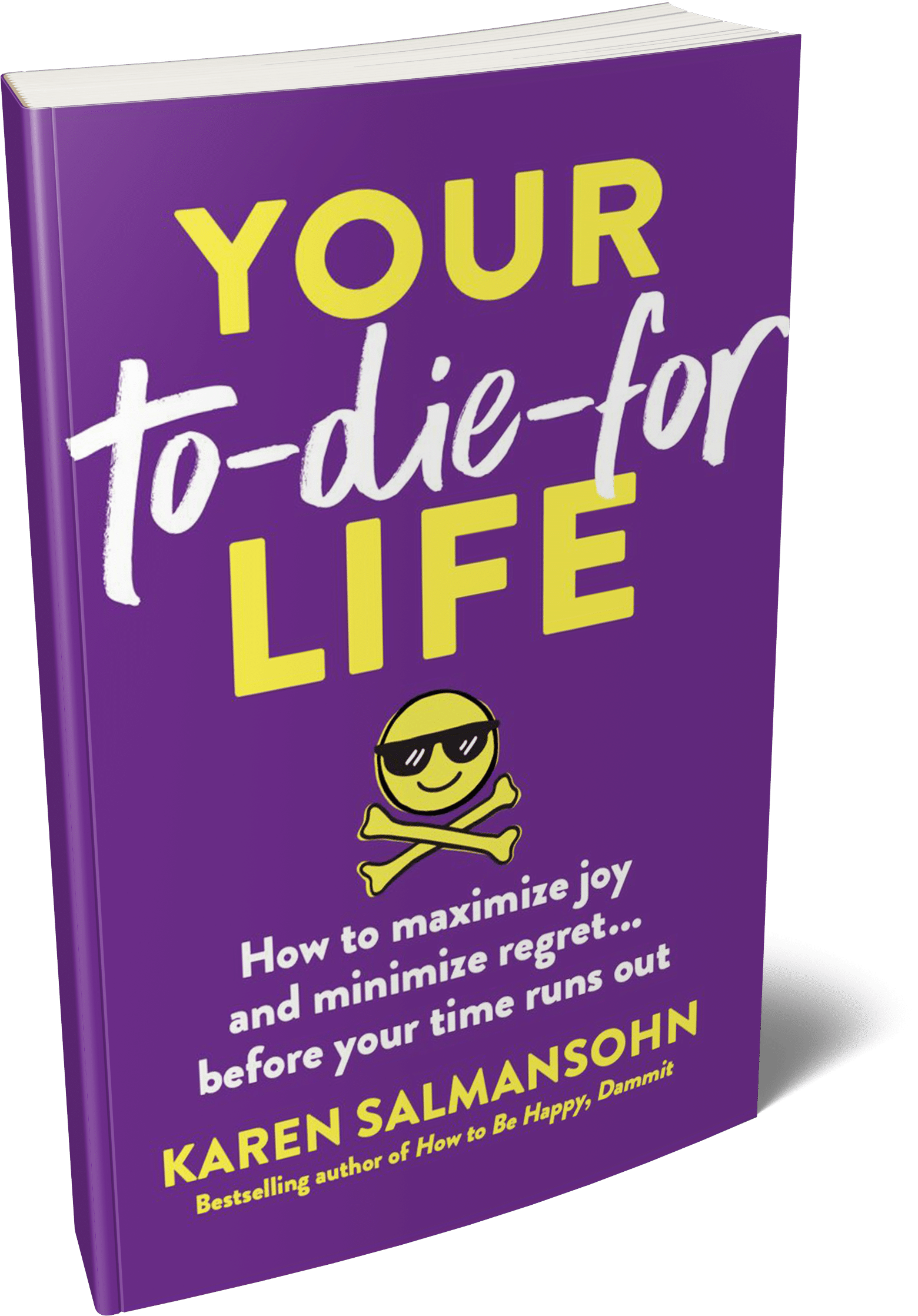

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.