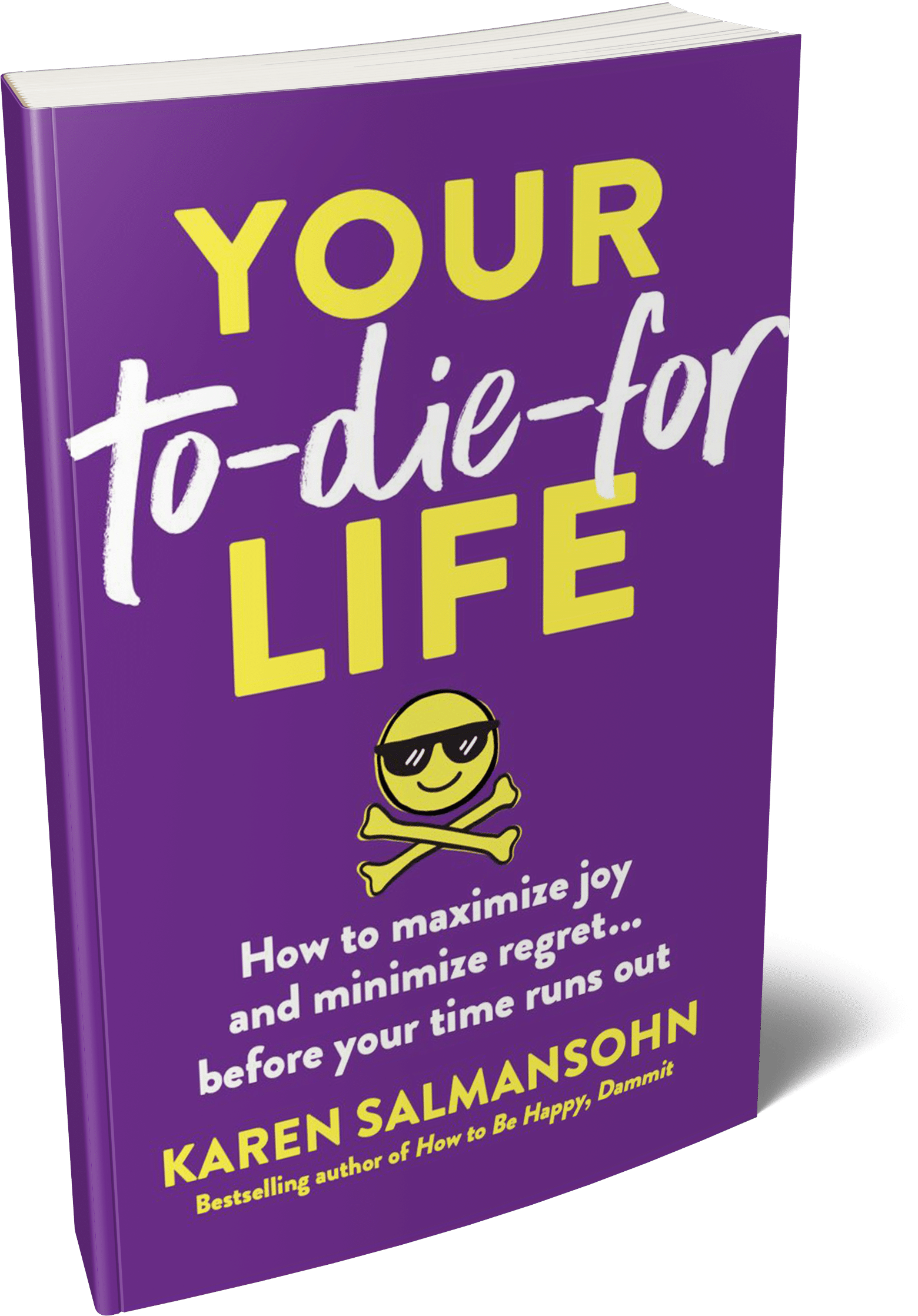

Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

Success in trading is usually judged by profits and win rates. The cost of participation is often ignored. Spreads, commissions, and platform fees steadily reduce account balances, sometimes before a strategy has a chance to work. As that pressure builds, patience drops and trading becomes less enjoyable.

Success in trading is usually judged by profits and win rates. The cost of participation is often ignored. Spreads, commissions, and platform fees steadily reduce account balances, sometimes before a strategy has a chance to work. As that pressure builds, patience drops and trading becomes less enjoyable.

Trading platforms look clean and intuitive on the surface. Behind that interface sits a business model designed to monetize every action you take. For retail traders, especially those with small or growing accounts, these costs shape outcomes more than most people admit.

Trading platforms earn in predictable but often overlooked ways. The most common is the spread, which is the difference between the buy and sell price of an asset. Every trade begins slightly negative because of this gap, even before the market moves.

Many platforms also charge commissions per trade or per lot. These fees feel small in isolation, which is why they are easy to ignore. After hundreds of trades, they quietly become one of the largest expenses a trader pays.

Beyond trading itself, operational fees add another layer. Platform access, data subscriptions, inactivity penalties, and withdrawal charges often appear after an account is already active. By the time traders notice, the damage is already done.

High trading costs change behavior, not just numbers. When a position starts in the red because of spreads or commissions, it creates tension immediately. Even good setups feel risky when fees are constantly eating into potential profit.

This pressure is amplified on small accounts. A fixed fee on a limited balance feels personal and heavy. Traders begin forcing trades, exiting too early, or chasing losses simply to feel justified staying active.

Lower costs remove that urgency. When the price of participation is reasonable, patience becomes easier. Traders wait longer, trade less often, and follow rules more consistently.

Spreads are the most common cost, but not the only one. Wider spreads reduce win rates, especially for short-term strategies. During volatile periods, spreads often widen further, compounding frustration.

Commissions are more visible but just as dangerous. Active traders can pay thousands annually without realizing it. Each fee raises the break-even point, forcing trades to work harder just to make sense.

Hidden costs deserve equal attention. Subscription tools, premium data, and inactivity fees punish caution. Funding and withdrawal charges also reduce real profits, especially for traders who move capital frequently.

Forex is generally the most cost-efficient market for active traders. High liquidity keeps spreads tight on major pairs, making small accounts more viable. Swap fees still matter for overnight positions, though many traders underestimate their impact.

Crypto trading is less predictable. Some exchanges offer low fees, while others charge heavily through spreads and withdrawal costs. During high volatility, these expenses increase when traders are already under pressure, especially for those trading on non-custodial platforms without proper asset protection strategies.

Indices and stocks operate differently. Index CFDs often have clear spreads with no per-share commissions, which suits day traders. Stocks tend to favor longer holding periods due to cumulative fees.

Lower trading costs improve expectancy in subtle ways. A setup with modest reward becomes more attractive when entry friction is reduced.

Cost efficiency also supports proper position sizing. Beginners can trade smaller sizes without fees consuming most of the potential reward. This allows real experience without forcing unnecessary risk.

When overhead is low, consistency improves. Traders are no longer pressured to trade just to justify subscriptions or platform access. Discipline becomes easier to maintain.

Finding reliable savings in trading requires trusted sources. Random discounts often come with hidden conditions. The following platforms stand out because they focus on verification and long-term value.

Vetted Prop Firms helps traders avoid costly mistakes in proprietary trading challenges. The platform compares evaluation fees, reset costs, drawdown rules, and profit splits across firms. This clarity prevents traders from paying for challenges that appear affordable but are difficult to pass in practice.

Its rankings emphasize reliability over marketing. Community feedback and payout history play a central role. Choosing fairer firms reduces pressure and allows traders to focus on execution rather than rule anxiety.

Active traders often spend more on infrastructure than they realize. VPS hosting, proxies, and automation tools quietly become recurring expenses. ProxyCoupons focuses on verified discounts for these services, making it more relevant than generic coupon sites.

Lowering monthly technical costs reduces the urge to overtrade. With less overhead, traders gain flexibility and preserve capital. Over time, these savings support more disciplined decision-making.

SaveMyCent uses human-verified deals to eliminate expired or misleading offers. This saves time and reduces frustration for traders managing multiple tools and subscriptions. The platform is simple and quick to scan.

It is especially useful for trading software, education, and digital services. Cutting these secondary expenses lowers overall financial pressure. That stability often translates into calmer trading behavior.

Start by estimating how often you trade and how large your positions usually are. This determines whether spreads or commissions matter more. Avoid choosing platforms based on marketing claims alone.

List fixed monthly costs such as data feeds or access fees. Use savings platforms to reduce these where possible. Treat trading as a business with predictable expenses.

Finally, value stability over the lowest price. A platform that saves a few dollars but fails during volatility costs far more in the long run. Reliability protects both capital and mindset.

Trading becomes more sustainable when costs are managed deliberately. Understanding how platforms earn money and reducing unnecessary expenses lowers emotional and financial pressure. The right tools help traders stay patient, disciplined, and consistent. Over time, saving money is not just about profit. It is about trading with clarity and peace of mind.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.