Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

Car accidents are frustrating. But what comes after? That can be even worse, especially if you live in San Jose, where accidents are common and insurance companies are used to closing cases quickly. The problem is, quick doesn’t always mean fair. And if you’re not prepared, you could walk away with less than you deserve.

Car accidents are frustrating. But what comes after? That can be even worse, especially if you live in San Jose, where accidents are common and insurance companies are used to closing cases quickly. The problem is, quick doesn’t always mean fair. And if you’re not prepared, you could walk away with less than you deserve.

The moment you report a crash, you step into a system that speaks its own language. Adjusters know it well. Most drivers don’t. That’s when confusion and pressure start to build.

If you’re already stressed from the crash itself, dealing with insurance can feel like too much. This article helps you get through that process without being overwhelmed or shortchanged.

After a crash, you might get a call from an insurance adjuster sooner than you expect. It could be the other driver’s insurer, or even your own. They may sound polite, understanding even, but keep your guard up. Their goal is often to save the company money.

You don’t have to speak with them right away. You have the right to say, “I’m not ready to talk about this yet.” In fact, it’s usually a good idea to take a breather, get your thoughts together, and speak with someone who understands these situations before saying too much.

When you do talk to an adjuster, stick to the facts. Don’t guess. Don’t downplay your injuries. And don’t ever say, “I’m fine,” unless you’re absolutely sure. Some injuries, especially injuries like whiplash or internal issues, don’t show up right away.

Also, avoid speculating about what happened. Just say what you know to be true. If you’re not sure about something, it’s okay to say, “I don’t know.”

Know When to Ask for Help

If you’re dealing with all of this in or around the San Jose area, you already know how busy the roads can get and how quickly a simple commute can turn into a collision. With so many drivers and heavy traffic, accidents here are unfortunately common. And when they happen, insurance companies don’t always make it easy to recover what you’re owed.

That’s when it helps to have someone local in your corner. Speaking with a car accident lawyer in San Jose can make a real difference, especially if your injuries are serious or the insurance company isn’t cooperating. A lawyer familiar with local courts and insurance practices can help you figure out if what you’re being offered is actually fair and what to do if it’s not.

Get Everything in Writing

Phone calls are one thing, but when it comes to your claim, written proof is gold. Ask for important details by email. If they make a promise or agree to cover something, ask them to send that confirmation in writing. It protects you if there’s a disagreement later.

Keep your own notes too. Write down the names of people you speak with, what they said, and the dates of your conversations. It might feel tedious, but it can save you a huge headache down the line.

Don’t Sign Anything Without Reading it Carefully

You might be offered a settlement early on. It may even seem generous at first glance. But once you sign that release form, your case is closed. There’s no going back if more bills pop up or your condition gets worse.

If anything feels rushed or confusing, stop. Get a second opinion. You’re allowed to have someone look it over, and honestly, you should.

Watch Out for These Common Tactics

You’d be surprised how subtle some of these methods are.

Being aware of these tricks doesn’t make you paranoid. It makes you prepared.

Focus on Your Health

It’s easy to let paperwork, phone calls, and claim numbers take over. But your recovery matters more than anything else. Go to your follow-up appointments. Stick with your treatment plan. And don’t be afraid to ask your doctor to document everything clearly.

If you skip care or don’t take your injuries seriously, the insurance company might argue that you weren’t really hurt. That can lower your settlement.

Final Thoughts

Dealing with insurance after a car crash isn’t just about filling out forms. It’s emotional, confusing, and often frustrating especially when you’re trying to recover and get your life back on track. It’s okay to feel overwhelmed. Most people do. But the key is not letting that frustration lead to rushed choices or missed opportunities.

You don’t have to do it all alone. Whether it’s leaning on trusted people in your circle or reaching out for professional support, there’s no shame in asking for help. Take your time. Keep track of everything. And never sign or agree to anything unless you fully understand what it means for you.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

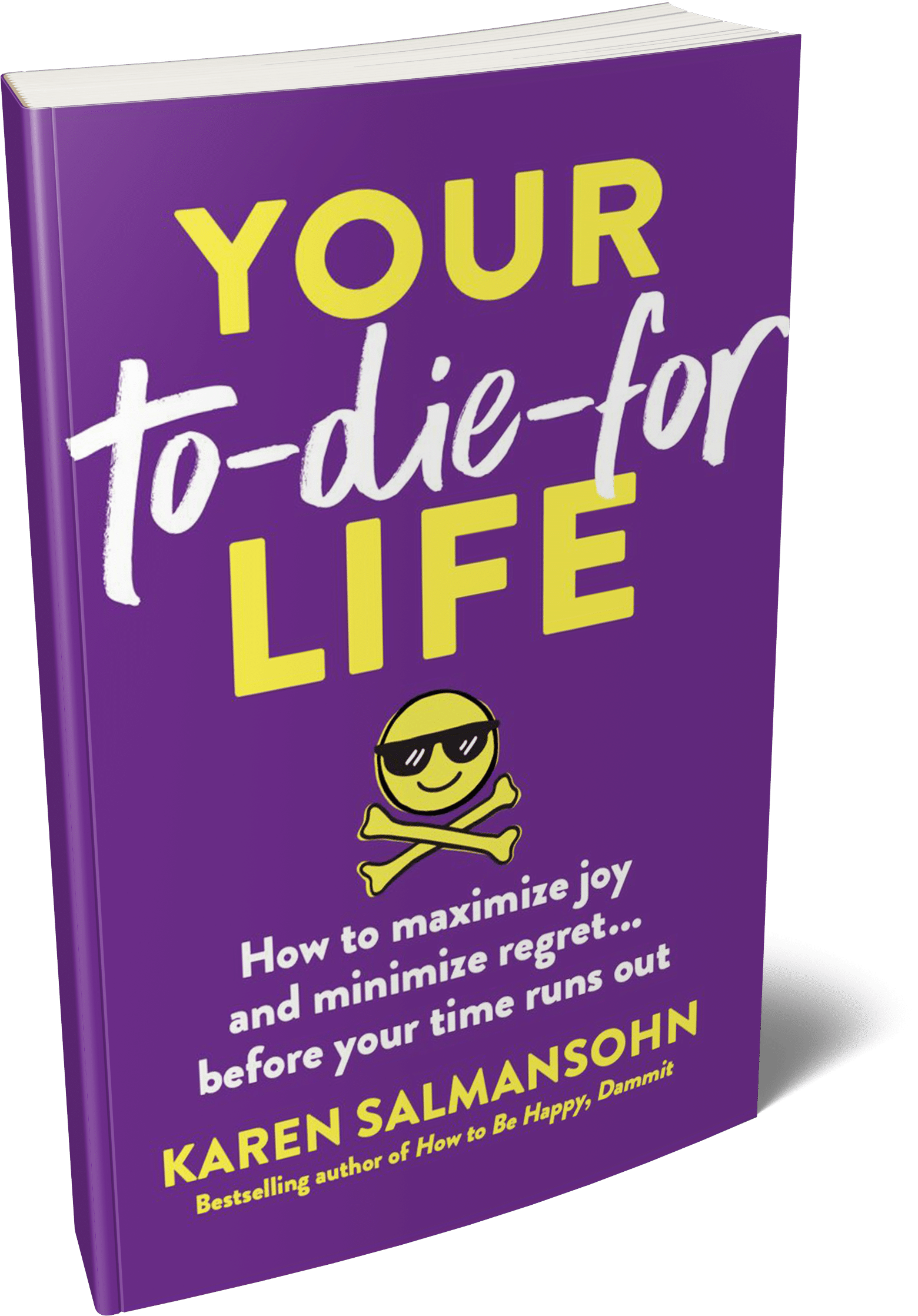

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.