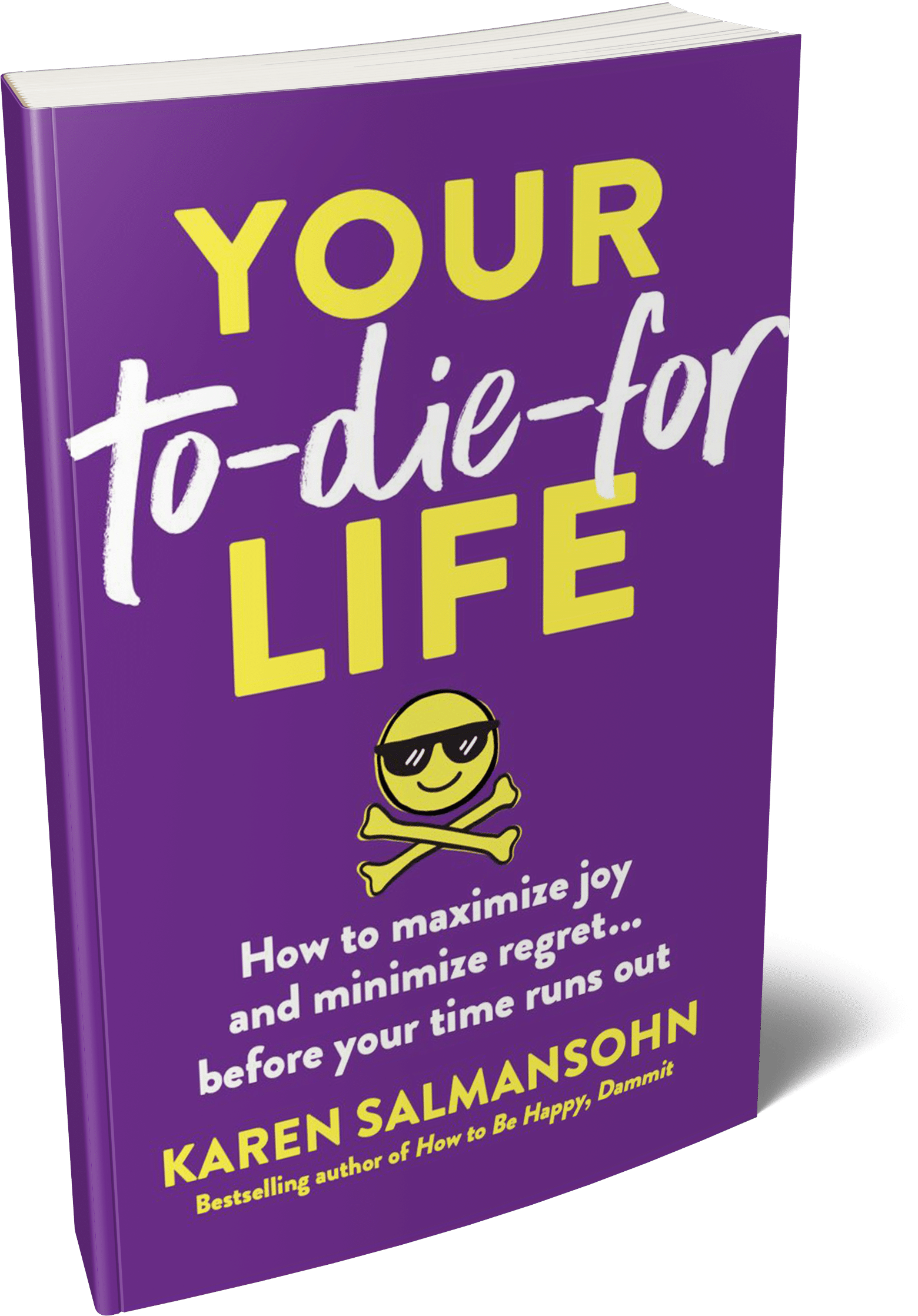

Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

Understanding beneficial ownership is essential for any business owner, whether you run a small startup or a large corporation. At its core, beneficial ownership refers to the real people who ultimately own or control a company, even if they’re not officially listed on paper.

Understanding beneficial ownership is essential for any business owner, whether you run a small startup or a large corporation. At its core, beneficial ownership refers to the real people who ultimately own or control a company, even if they’re not officially listed on paper.

With global efforts to increase transparency and reduce financial crime, beneficial ownership is a hot topic. Here are ten critical insights that every business owner should know about beneficial ownership information and why it matters.

Those individuals who have control over or benefit from a business entity are referred to as having beneficial ownership, even if they are not the legal owners on record of the business entity.

The ownership of a sizeable number of the company’s shares or voting rights is typically the means by which this individual is able to wield a great amount of influence over a firm. Knowing who the beneficial owners of a company are is vital for ensuring compliance with legal and regulatory requirements in various areas of the world.

As a means of combating problems such as money laundering, financing of terrorist organisations, and corruption, governments all over the world have increased their efforts to improve transparency in ownership structures. Regulators are exerting pressure on firms to reveal the identities of their beneficial owners through the implementation of policies such as the Corporate Transparency Act in the United States.

For the purpose of ensuring compliance and avoiding potential penalties, owners of businesses need to have a solid understanding of these transparency obligations.

Disclosure of beneficial ownership may be a legal obligation in your area, depending on the specifics of the situation. As an illustration, the Financial Crimes Enforcement Network (FinCEN) in the United States mandates that businesses reveal information regarding the individuals who hold beneficial ownership of their assets. In order to maintain compliance with regulations and avoid incurring expensive fines, owners of businesses need to become familiar with their reporting requirements.

Beneficial ownership reporting is critical to global AML efforts. Money launderers often hide behind complex corporate structures to obscure the real ownership of assets, making it difficult for authorities to track illicit funds. Knowing and disclosing beneficial ownership helps authorities connect the dots in financial crime investigations, making AML efforts more effective.

Failing to disclose beneficial ownership can lead to severe financial and legal consequences. Regulatory bodies impose hefty fines on businesses that do not comply with beneficial ownership reporting requirements. In some cases, company directors and officers may face personal liability for non-compliance. Business owners should ensure they understand and meet these requirements to protect themselves and their companies.

Understanding who the beneficial owners are within your business can also impact corporate governance. Beneficial owners often have significant influence over a company’s decisions, which can affect the company’s strategy, operations, and culture. Knowing who these individuals are helps business owners ensure that their interests align with the company’s goals and values.

One of the challenges of beneficial ownership reporting is balancing privacy with the need for transparency. Some beneficial owners may be concerned about disclosing their ownership publicly due to privacy or security concerns.

However, business owners need to navigate these concerns carefully, as failure to disclose beneficial ownership can result in legal repercussions. Understanding the balance between transparency and privacy is essential.

For businesses receiving foreign investment, beneficial ownership transparency is especially important. In many countries, authorities scrutinise foreign investments to prevent undue influence or control by foreign entities.

Clear and transparent beneficial ownership structures make it easier for businesses to demonstrate that their investments are legitimate and not aimed at bypassing national security concerns.

Navigating beneficial ownership regulations can be complex, but resources are available to help business owners comply. Organisations like FinCEN provide guidance on reporting requirements, and various software tools can assist in identifying and documenting beneficial owners. Staying informed about the latest regulations and using available tools can help streamline the compliance process.

As global regulations evolve, the focus on beneficial ownership transparency is likely to intensify. Business owners should stay informed about potential changes to beneficial ownership reporting requirements and proactively adapt to meet them. Engaging with industry groups and following regulatory updates can help business owners stay ahead of compliance requirements and avoid last-minute adjustments.

Understanding and addressing beneficial ownership is more than a regulatory checkbox; it’s a critical aspect of modern business operations. Staying informed about beneficial ownership requirements not only ensures compliance but also supports broader efforts to promote transparency and combat financial crime. By keeping these 10 key points in mind, business owners can navigate the complexities of beneficial ownership with confidence.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.