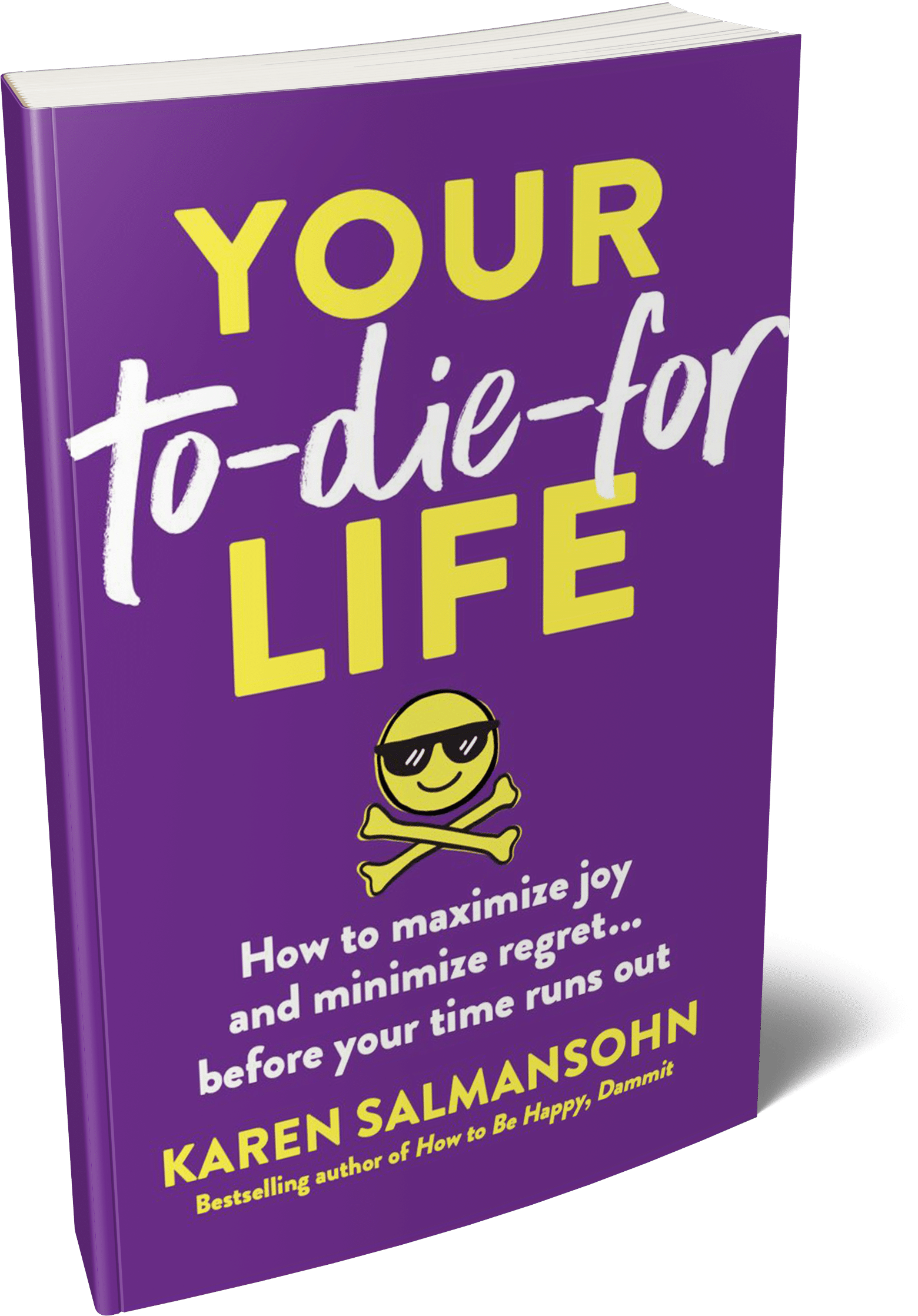

Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

The development of money management abilities stands as a fundamental achievement for teenagers during their growth process. Young people face multiple challenges when they start handling their finances independently as they transition from children to adults.

The development of money management abilities stands as a fundamental achievement for teenagers during their growth process. Young people face multiple challenges when they start handling their finances independently as they transition from children to adults.

Students who learn money management techniques before starting college will be better prepared to handle financial responsibilities that arise during higher education.

The guide provides complete information for teens about saving money in a piggy bank and budgeting for tuition fees and other expenses.

The majority of people begin their financial path through a piggy bank. The first stage of saving money seems easy, but it creates the foundation for people to establish basic financial skills. The concept of saving money to achieve objectives starts for you as a teenager, even if your goals might seem insignificant.

Begin your piggy bank savings by putting aside money from your allowance, any financial gifts, and income from your small work activities. The practice seems unimportant at first, but it helps you develop self-control while building your habit of saving money. The process of saving even small amounts of money weekly creates a growing fund that brings happiness through visible financial progress.

Children at this stage need to develop their understanding of what makes something essential compared to what is just wanted. People often buy things they do not need. A piggy bank functions as a physical tool that shows your current savings remain dedicated to future achievements rather than instant pleasures.

The first step in saving money is to open a bank account. A personal bank account is essential for managing your finances more effectively. It’s a safe place to keep your money, offering many benefits, such as easy access to funds, spending tracking, and guidance on avoiding fees.

You must decide to open either a checking account or a savings account. A checking account lets you put money in and take it out without difficulty, yet a savings account provides better interest rates, which makes your funds increase. A checking account offers greater convenience for teenagers because it allows them to access their money whenever necessary.

The selection process for a bank should include evaluating the banking fees, minimum account requirements, and the bank’s mobile application capabilities for account management. Online banking setup provides users with convenient balance monitoring and deposit and fund transfer capabilities between their accounts.

You need to make a budget after establishing your bank account. The ability to budget is a fundamental financial management skill that young people should learn in their early years. A budget helps you track where your money is going, so you can ensure that you’re saving enough for your goals.

Start by listing all your sources of income—whether it’s from an allowance, a part-time job, or other sources. Then, categorize your expenses. The list of basic needs includes food, entertainment, transportation, and personal belongings. Your fixed costs, which include phone bills and subscription services, need to be tracked alongside your discretionary spending, like dining out and clothing purchases.

The process of budget creation requires only a pen and paper, or you can select specialized budgeting applications, which make the task easier. Teen users find Mint and YNAB (You Need a Budget), along with basic Excel spreadsheets, to be their preferred budgeting tools. The key to budgeting is consistency—make sure you update your budget regularly to keep track of your progress.

Teenagers face their most difficult financial obstacles when they try to save money for college expenses. The cost of college becomes unaffordable because students need to pay for tuition fees and additional expenses. The college experience demands that students handle expenses, which include buying textbooks, paying for room and board, food, and transportation costs.

You need to establish particular financial targets for your college savings plan. The first step requires students to research their target school’s tuition fees for both in-state and out-of-state students and calculate all related expenses. You need to split your required savings amount into achievable segments that you can handle each month or year.

The example shows that you need to save $208 each month to reach your $5,000 goal within the next two years for tuition and related expenses. The process of automating your savings will help you maintain your financial goals. Saving money for college becomes more effective when students establish separate savings accounts, as this allows them organize their funds and maintain focus on their educational goals.

You will probably require additional income sources to save money effectively. The second option requires you to find part-time work, freelance opportunities, or provide community-based services. Teenagers have multiple opportunities to earn money through babysitting, tutoring, dog walking, working in retail, and food service jobs.

Working while attending school helps you save money, yet you need to maintain a proper balance between your responsibilities. Your academic work should remain your highest priority, as you must manage your time properly to prevent your job from affecting your schoolwork. Students who work while attending school gain valuable experience that creates financial stability and professional growth for their future.

Learning about credit alongside its operational system will help teenagers when they reach adulthood. A high credit score leads to lower interest rates for future loans, but a bad credit history results in expensive borrowing options and restricted access to loans. This can even extend to private student loans, which often come with higher interest rates for those without a strong credit history. Learning how to handle credit properly serves as an essential need for everyone.

Students who want to build credit should think about getting a student credit card. These cards work best for new cardholders because they provide limited credit access. People need to handle their credit responsibly by avoiding overspending and ensuring all payments are made before their due dates. Credit card debt will get worse if you don’t manage it properly.

Understanding payday loans and high-interest loans is vital because these financial tools can create significant monetary problems for people. The process of borrowing money requires knowledge and awareness of all possible risks.

Students need to research their financial aid options before they begin their college journey, as these resources include scholarships, grants, and loans. Students who want to reduce their borrowing needs can qualify for multiple scholarships available to high school students before college enrollment.

The Free Application for Federal Student Aid (FAFSA) is the essential step toward obtaining financial assistance for education. The application process determines which students qualify for federal loans, grants, and work-study programs. Students who submit their FAFSA applications early stand a better chance of obtaining financial aid.

Students can find private scholarships through organizations, local businesses, and online scholarship databases. Apply to as many scholarships as possible to boost your chances of getting funding.

Students need to handle their financial operations differently when they start their college journey. College students need to handle various financial responsibilities, which include purchasing textbooks and food, participating in social events, and paying for transportation. Your budget needs to adapt because these new expenses have appeared.

Create a dedicated checking account for your college expenses and restrict all college-related spending to that account. This will help you avoid overspending and ensure that you can track your expenditures. Students need to set monthly spending limits for their discretionary expenses, which include dining out and clothing purchases.

The process of saving money stands as an essential financial skill that college students must understand. Students should prepare their own meals at home to save money instead of eating out. They should also take advantage of student discounts and explore free or affordable campus activities. The minor adjustments we make today will lead to significant savings in the future.

Your first money management experience before college will establish the base for your lifelong financial success when you find the right approach. Begin with saving money and learning about credit and budgeting. Then, focus on earning extra money, applying for scholarships, and preparing for the financial realities of college. The actions you take today will help you build confidence and economic stability for your college experience.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.