Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

Life has a way of sneaking up on you. One minute you’re happily living on takeout and autopay bills, and the next you’re signing a marriage license, pricing out daycare, or nervously updating your LinkedIn after a career pivot.

Life has a way of sneaking up on you. One minute you’re happily living on takeout and autopay bills, and the next you’re signing a marriage license, pricing out daycare, or nervously updating your LinkedIn after a career pivot.

These milestones are exciting, but they also rewrite your money story almost overnight. Your budget, savings goals, tax strategy, and insurance coverage all shift the moment a big life change happens. And if you live in a state like New Jersey, where high property taxes and cross-state commutes are just part of everyday life, those financial shifts can feel even sharper.

The good news is you do not have to figure it all out the hard way. A financial check-up after major transitions helps you take control early, before small oversights snowball into long-term stress. Here’s how to do it step by step, without letting money anxiety steal the joy from your new chapter.

Marriage is not just a celebration; it is a merger. Your debts, credit scores, and tax brackets are suddenly in the same family photo. This is the perfect time to:

Decide how money will move day to day: joint accounts, separate accounts, or a hybrid. Set rules before the first surprise bill. Couples who agree on a budget and roles early tend to avoid the “wait, we spent what?” conversation later.

If you want expert help aligning all the moving parts, consider working with a financial advisor in Summit, NJ at Grand Life Financial who can coordinate cash flow, filing status, and investment choices without sales pressure. A pro who understands local tax quirks and cross-state income can save years of friction.

Kids change everything, including your financial plan. The earlier you adjust, the less stressful it becomes:

Do not forget to update your will and name guardians for your child. It is not fun to think about, but it is one of the most important protections you can put in place. Also, consider the impact of childcare costs on your budget. In many areas, daycare expenses can exceed housing payments. Planning for these costs early keeps you from dipping into savings unexpectedly.

A raise, promotion, or career switch feels exciting until tax season shows up. Here’s where to focus:

Big job moves are also a good time to revisit your investment mix. If your compensation now includes company stock, you may need to rebalance your portfolio to avoid putting too many eggs in one basket. And if your income drops temporarily, such as when starting a business, build a cash buffer to cover those lean months so your long-term savings stay on track.

Buying, upsizing, or even downsizing your home can have a huge ripple effect.

If you are selling a home, remember to account for closing costs, realtor commissions, and any repairs required by the buyer. A home purchase or sale is also a great moment to review your homeowners’ insurance and ensure you have enough coverage for replacement costs.

Whether you are planning a wedding or switching careers, you can use this simple process every time life changes:

This keeps you proactive instead of reactive and stops money stress before it starts. You can revisit this process once or twice a year to make sure your finances stay aligned with your life.

Financial problems rarely happen overnight. They build quietly with a missed tax adjustment, a forgotten beneficiary form, or a budget that never adapted to your new job. Catching these small things early keeps them from turning into something bigger.

A life transition is the perfect moment to pause, check in on your money, and make sure your plan reflects where you are right now. It is not about complicating things, it is about setting up your finances so you can enjoy the exciting parts of life without constant money worries.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

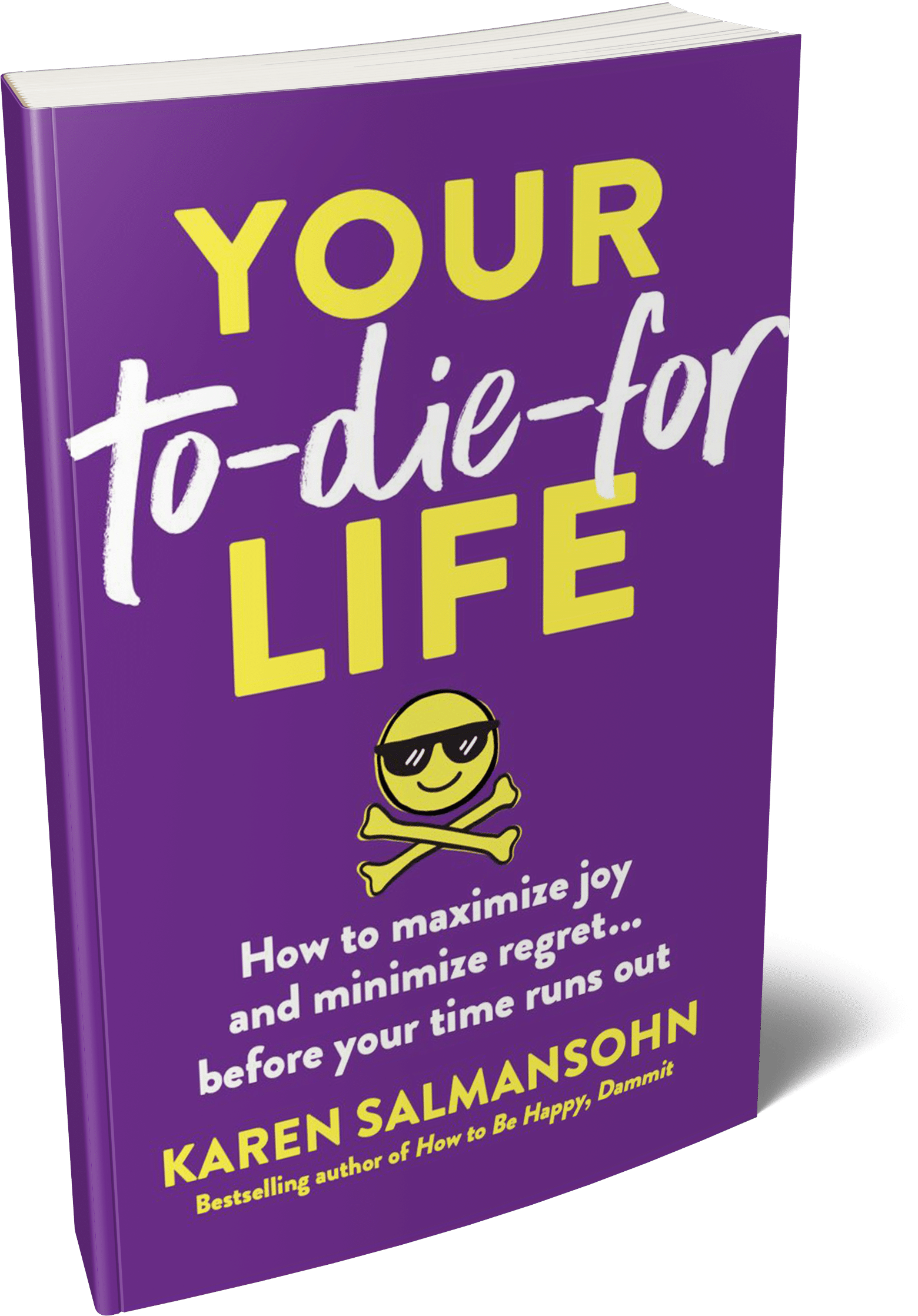

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.