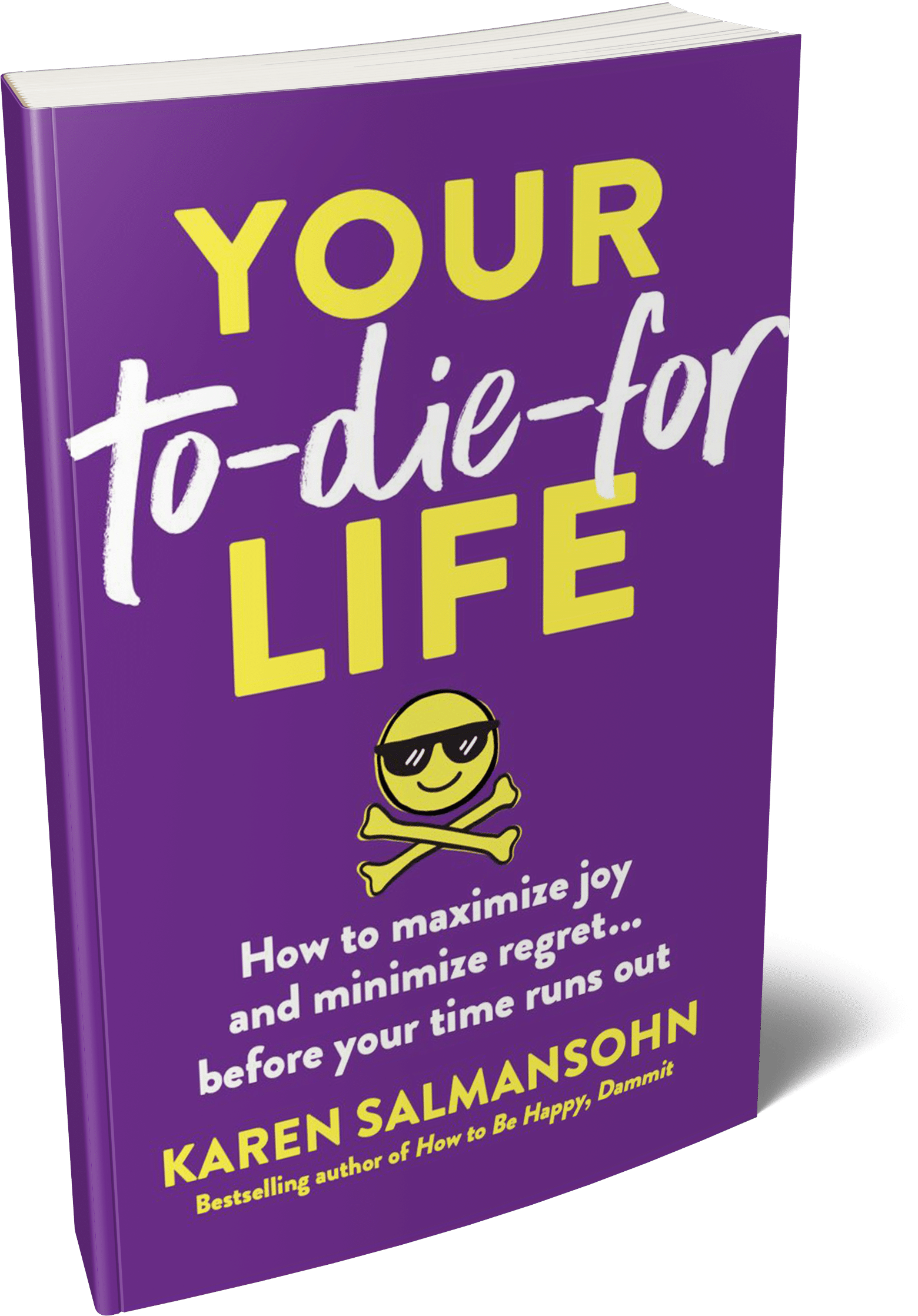

Get A Sneak Peek at my book “Your To-Die-For Life”!

Get a FREE sneak peek! Learn how to use Mortality Awareness as a wake up call to live more boldly.

As a lover of real estate, I’m excited to share with you some top buying considerations may make life easier for first time homebuyers.

As a lover of real estate, I’m excited to share with you some top buying considerations may make life easier for first time homebuyers.

According to the National Association of Realtors, 31% of the residential real estate market’s buyers in 2019 were buying for the first time. With so much going into purchasing a home, legally and financially, people should take steps to get ready before jumping into the market.

As you might know, I’m an award winning designer of bestselling books (like The Bounce Back) and video courses (like The Anxiety Cure).

I also love home design as much as book and video course design! In fact, I spent a lot of time exploring how to renovate our home. Check out our home design here.

I love to share everything I have learned about getting a home and improving upon its value. With that said, I put together this article with top buying considerations for first time homebuyers.

Successfully purchasing a home and making the most of the experience often depends on getting the innumerable details in line. Using these tips may help potential homebuyers avoid some common pitfalls and stresses of purchasing residential real estate properties.

More than possibly any other purchases people make, buying homes necessitate financial preparation. To this end, people may benefit from starting to save early and determining how much they can afford before starting to shop properties. Home buyers should also look into getting help from a place like Altrua Financial (or a place your friends or family recommend) in order to secure the best mortgage rates possible. Plus all homebuyers should account for their projected mortgages, as well as other costs that come with homeownership, such as homeowner association fees and property taxes.

For many would-be homebuyers, their credit scores play a central role in determining their mortgage qualifications. When getting ready to buy and shopping for a home, then, taking steps like paying all bills on time and keeping existing credit cards open but with small balances may help people improve their credit and chances for approval. By the same token, they should avoid making large purchases or taking out other lines of credit, as this may affect their credit scores or other such factors considered in qualifying for home loans.

When shopping, first-time homebuyers should look for properties with their budgets and their needs in mind. If you’re looking at Victoria BC real estate, make sure to use a realtor that knows the area well. After finding homes they wish to purchase, potential buyers often benefit from paying for a home inspection. Home inspectors examine properties from top to bottom and may identify potential structural or mechanical problems. Pointing out these types of issues let would-be buyers know about a home’s quirks before making their decisions, so they may choose to ask for repairs or price reductions, or back out before closing. Additionally, finding issues such as these may help prevent a slip and fall accident or other accidents resulting from dangerous property conditions.

First-time homebuyers frequently find it helpful to get the appropriate insurance coverages to protect their investments. For example, they may have to obtain a title insurance policy for their mortgage companies to safeguard against disputes arising from previous claims on the property. It also generally benefits people to have homeowners’ insurance coverage, to provide compensation in the event of certain home damage. Depending on the type of property they own, the pets they keep on their property, and other factors, homebuyers may also consider purchasing liability coverage for the event that anyone gets injured on the property. For instance, a homeowner with horses may want additional financial protection from accidents that may occur on their properties.

Knowing their rights and responsibilities may help first-time homebuyers as they navigate the process of saving for, shopping for, and purchasing residential real estate properties.

P.S. Before you zip off to your next Internet pit stop, check out these 2 game changers below - that could dramatically upscale your life.

1. Check Out My Book On Enjoying A Well-Lived Life: It’s called "Your To Die For Life: How to Maximize Joy and Minimize Regret Before Your Time Runs Out." Think of it as your life’s manual to cranking up the volume on joy, meaning, and connection. Learn more here.

2. Life Review Therapy - What if you could get a clear picture of where you are versus where you want to be, and find out exactly why you’re not there yet? That’s what Life Review Therapy is all about.. If you’re serious about transforming your life, let’s talk. Learn more HERE.

Think about subscribing for free weekly tools here.

No SPAM, ever! Read the Privacy Policy for more information.